Who’d have thought there’d be so many reasons to retire? Generationally, we’re living longer healthier lives and many folks have chosen to extend their working years. On the other hand, more people than ever before are retiring early.

The best reasons why you should retire usually hinge on age / savings. Seldom is it that simple, as personal factors greatly influence this decision. These include declining health, feeling burnt out, low job satisfaction, family obligations or simply wanting to enjoy life.

Let’s be clear, there are many reasons to retire and just as many why you shouldn’t. It all comes down to your personal situation and what you want. Generally, it’s a combination of things leading up to the big decision.

Our article, The Best Age to Retire for Longevity and Happiness, revealed your mid-fifties is the optimal age to retire. These retirees are young and healthy enough to make the most of their next stage of life. The obvious caveat is they’ll require more money than someone who works an additional decade.

Obviously, not everyone is able, or necessarily wants, to retire that early. Having stated this, the following are 21 reasons which might influence your timing.

1. The Most Common Reason for Retiring - Your Age

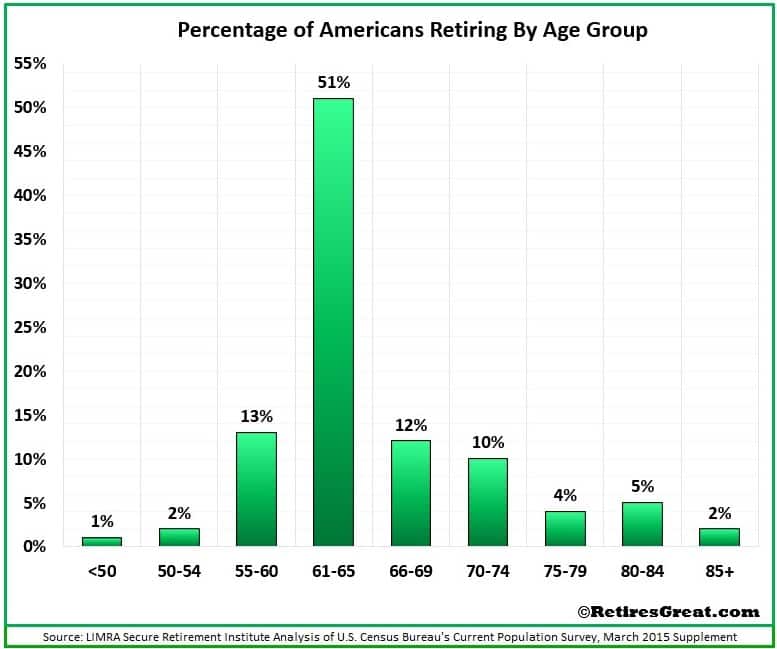

The most common reason for retiring is turning a certain age. For instance, slightly over 18% of Americans leave the workforce at age 62. Interestingly, this coincides with Social Security eligibility.

Furthermore, over half of people leave between the ages of 61 and 65. Thus, for many, age appears to be a milestone signalling it’s time to leave work behind and move on to their next phase of life. For more information, see Should You Retire at 62.

2. Financial Independence

A second milestone would appear to be achieving financial independence. It’s also one of the best reasons why you should retire. This will vary for each person, yet the question is “how much is enough”?

It largely depends on the lifestyle you want and desire. Unless you love your job, you’re probably already evaluating the trade-off between working a few more years and living the life you always wanted. If an inheritance were to come your way, this might further clarify your finances.

An interesting comment from a retiree in one forum, he calculated an extra year of work didn’t make much difference in his retirement income. He referred to it as a measly twenty bucks a month which helped him realize it wasn’t worth it to him.

Related post: Fear of Retirement and Outliving Your Savings

3. You're Debt-Free

Congratulations on becoming debt-free!

Your home is paid off, no more car payments and you’re financially prepared. Why put in more years of work? For many folks, this is about beginning the next phase of life.

Some may have downsized or plan on relocating to an area with a lower cost of living. Somewhere warmer or closer to where they want to be. It could affect your quality of life.

4. Slow Down and Enjoy Life

One of the best motives for retiring is the almost universal desire to slow down and enjoy life. After decades of hectic work lives, the chance to finally take it easy can be very appealing. No more alarm clocks and all the freedom to do what you want.

It should also be noted, all the stress and frustrations with some jobs could impact health and even lifespan.

Related post: How to Retire Gracefully

5. Time with Family and Friends

When we’re younger, our time is filled with working, raising a family, the never-ending “honey do” list and day-to-day activities which seem to fill every waking minute. When it comes to family and friends, sometimes it becomes “tomorrow I’ll call or set up a time to visit”.

Unfortunately, as we age if we postpone too long it could be too late. Losing a loved one gives a whole different perspective and sticking it out for another year or two may not be as important anymore.

6. Travel

Travel is on a lot of people’s bucket list. According to the Transamerica Retirement Survey, 67% of American workers plan on traveling after leaving work. Further to this, Investopedia found the average retiree spent $11,077 a year on travel.

It could be to a particular destination or visiting family more. And you want to travel while you’re still young enough to enjoy it. Work inhibits the ability as, usually, there are guidelines to how much time one gets and when it can be used.

7. Starting a New Career

Out with the old and in with the new! Retirement is a crossroads and it gives you the opportunity to pursue your true passions.

Perhaps getting involved with a non-profit and volunteering your time to a worthy cause. Or, maybe becoming an entrepreneur and starting your own business. With all the years of experience and business contacts, we’re poised for much greater chances of success.

A study by the Kauffman Foundation, reveals over a quarter (25.8%) of all new businesses were started by those between the ages of 55 to 64. See our article, Unretirement: 9 Best Reasons to Work After Retiring, for some suggestions.

8. Your Spouse / Partner Has Retired

Often, after one partner leaves their job the other might question if they want to remain working. They might love their career and stay. Or transition to a more part-time basis to spend time with their spouse.

If the job isn’t something enjoyable, this situation could make them seriously consider retiring. Why Should Spouses Retire Together sheds more insight into this topic.

9. Affordable Health Insurance

One of the greatest deterrents to retiring early (before 65) has been the high cost of healthcare insurance. With recent changes to the Affordable Healthcare Act, you might be surprised to find more reasonable costs.

Healthcare costs are one fear that may be a little bit more manageable. The 8 Greatest Retirement Fears expands upon the many unknowns in retirement.

10. Maxing Out Your Pension

Although defined pensions seem scarcer than “hens’ teeth”, anyone fortunate enough to have one is earning a life long pension. While these pensions are highly desirable, they can also lead to feelings of trapped by “golden handcuffs”.

For example, depending upon the organization, industry might pay higher wages for comparable skills. Or, the employee might be stuck in an unfulfilling position with limited career advancement opportunities.

After enough years of service, eventually the contributions will be maxed out. This can often be a trigger point to leave.

11. Incentive for Retiring Early

Most organizations actively look for ways to reduce expenses. Younger workers generally cost less and there may be incentives for older employees to leave. These might consist of cash bonuses and / or extended benefits.

Something important to consider is the offer may not be made again. If you plan on retiring in a year or two anyways, you might be better off accepting the deal. Likewise, there’s no guarantee you won’t be let go further down the road.

12. Staying Healthier Longer

Your good health may not last and where you work may, quite literally, be killing you. High stress, exposure to unsafe working conditions or physically demanding activity could be taking a toll.

Coupled with any health concerns, such as an underlying condition, leaving could improve your quality of life and extend your healthy years.

13. Health Issues

As we age, health issues tend to creep up. In some situations, trying to squeeze in a few more years of work doesn’t seem worth it. The truth of the matter, money doesn’t matter as much when your health is failing.

This underscores the importance of health and how it can become a critical factor in the decision to leave work.

14. Need to Care for a Family Member

Long-term care facilities are expensive. If someone you love is struggling, you might find yourself assisting them on a day-to-day basis if hiring outside help is not an option.

This could include an elderly parent, spouse or child requiring a little more help or even becoming their primary care giver.

15. Lack of Fulfillment at Work

You might be in a situation where your job has become tedious and boring. After all these years, you can almost do it in your sleep and it no longer offers any challenges. If you’ve financially prepared, this might be the time to consider moving forward.

16. New Management Direction

The world is changing with almost every organization forced to adapt. Many are moving to a greater online presence and / or call centers. Perhaps services are being outsourced.

Existing divisions and regional offices may be closing. Some of these changes might force you to relocate or into a different / lesser position. From your perspective, you might be questioning if it’s time to leave.

17. Not Seeing Eye-to-Eye with the Boss

One of the best reasons why you should retire is not seeing eye to eye with your manager. Not all bosses are created equal! Your supervisor might be incompetent or an arrogant ass.

Instead of recognizing and rewarding stellar performance in their employees, their goal is to make themselves appear more important than they really are. Not a great position to be in and might have you wondering if it’s time to pull the plug, so to speak.

Both my wife and I have been there. There’s nothing more demeaning than having your performance and contributions being marginalized and diminished. Debbie discusses more of her experience in her Bad Boss post.

18. Ageism

Although no company will ever admit it, ageism is alive and well in America. Management believes in “fresh blood” and promoting their rising young stars. Meanwhile, years of loyalty are discounted and experienced employees are viewed as expensive liabilities.

Your boss and most of your co-workers are likely half your age. We’re viewed like dinosaurs with our input not appreciated. If you’re in this position, your days may be numbered as management figures out a way to get rid of you.

19. Working Conditions

Another one of the best reasons why you should retire is unhealthy working conditions. Let’s be candid, nearly half (45%) of American workers hate their jobs! If you’re one of them, retiring early will be appealing.

On average, you spend about 40 hours a week at work. When it becomes a soul sucking experience, it’s hard to feel happy, upbeat and positive. Some conditions can make this massive chunk of your life unbearable include:

20. Working from Home

Nowadays, most knowledge workers are able to efficiently work from home. Some organizations have embraced remote work policies; whereas others continue to resist them. Old school management still counts “bums in seats” and don’t fully trust their employees.

Perhaps you appreciate this flexibility. If you’re now expected to be at the office each and every day, you likely aren’t pleased especially when it requires a long commute each day.

Conversely, you be one of those who needs and enjoys the camaraderie and being at the office. Company policy may have shifted to encourage working from home. This could allow them to slash office and real-estate expenses.

In either situation, you may not be happy with the changes and questioning if it’s time to finally “pull the plug”.

21. Job Loss

Job loss, particularly for older workers, is a driving force of early retirement. Often, this is a result of corporate downsizing and not the employee’s choice.

The sad truth, it’s far more difficult to find good paying employment opportunities once you’re 50 or older. Unemployment and lay-offs disproportionally affect older workers more than younger ones.

Even with exceptional skills and knowledge in your industry, it might not be enough and this might be the time to consider retirement.

How to Deal with Forced Retirement provides insights into coping with job loss.

Closing Thoughts on Best Reasons Why You Should Retire

While it used to be somewhat clear cut, now there are many more considerations affecting when to “pull the plug”. This is a vastly different world than our parents and previous generations ever experienced.

Age and finances remain the primary factors with the most common retirement ages coinciding with Social Security and Medicare eligibility. However, personal reasons usually influence the decision-making process.

For many it’s about slowing down and enjoying life. Perhaps their partner is retired and they want to travel more. In other situations, it could be one or a combination of things over which they have little control.

Examples might include job loss, work dissatisfaction, feeling burnt out, declining health or looking after a loved one.

Regardless of the reasons, everyone contemplating retirement needs to take their own personal situation into account when making this important decision.

My brother suggested that I check out this website, and he was 100% correct. This post brightened my day, and you have no idea how much time I spent searching for this information.