There are no guarantees in life and many baby boomers worry what could go sideways after they retire. While it makes sense to be aware, fretting and worrying about what might or might not happen isn’t healthy. S

So, let’s look at the greatest fears in retirement and how to overcome them.

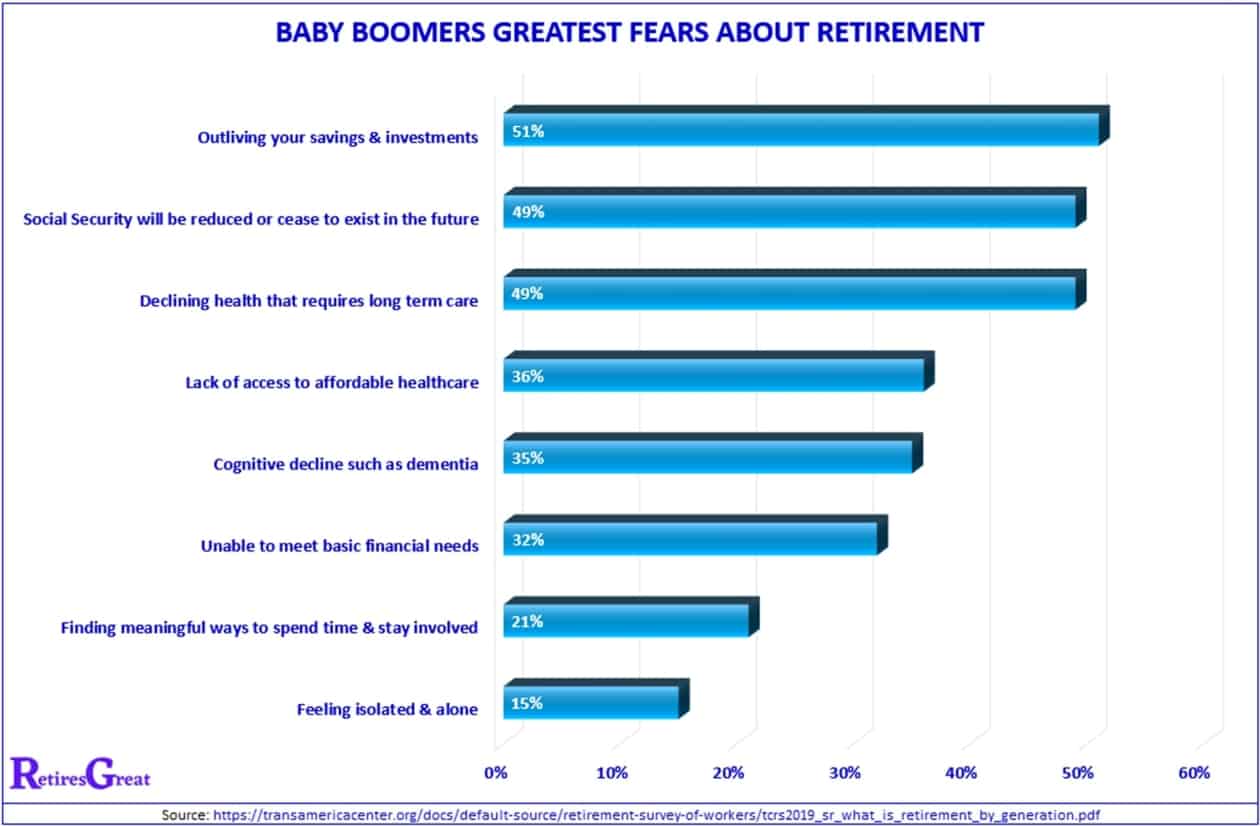

The 8 greatest retirement fears include:

The Transamerica Center produced a 132-page report documenting the concerns of over 5,000 Americans across the country. Understandably, we should all be aware of what could go wrong and do our best to take preventative action.

Some folks will extend their working years just to be on the safe side. While they gain greater financial security, they could be missing out on the best years of their life.

In other situations, instead of enjoying retirement, they’re haunted by the looming thought of what might come to pass. Do you share any of these retirement fears? How do you handle them?

#1. Outliving Your Savings and Investments

One of the greatest retirement fears (51%) is outliving your savings and/or investments. It’s no wonder when the average American only has savings of $152,000. Making matters worse are all the uncertainties we face, such as:

For more insights, see Fear of Out Living Your Savings.

How to Overcome

The old adage is “plan for the worst and hope for the best”. This is why many choose to extend their working years. The more financially secure you are the better your chances to ride out any setbacks.

You’ll also want to ask yourself how much is enough. For those who’ve achieved financial security, fear of the unknown might still dominate their thoughts.

By creating a financial plan, you gain “peace of mind” your money will last throughout your lifetime. How to Write a Retirement Plan outlines how to address both the financial and softer side of planning.

#2. Social Security Will Be Reduced or Cease to Exist

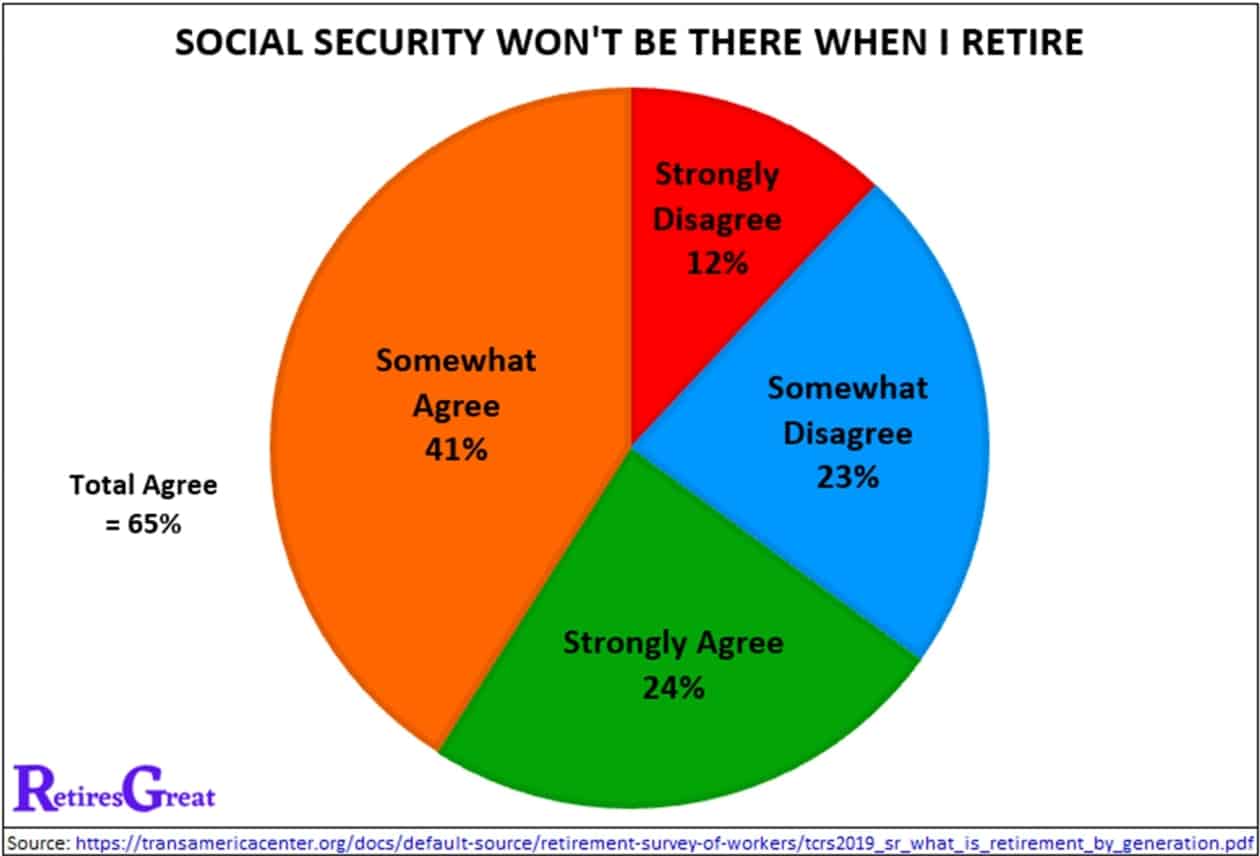

Almost half of the respondents (49%) are concerned what’ll happen to Social Security. Administrators acknowledge, as early as 2029, trust funds will be exhausted if changes aren’t made.

Whether benefits are reduced or the program ceases to exist is open for debate. Over the past century, everything’s changed with life expectancy steadily increasing.

Today, slightly more than 21% of the population are baby boomers who are, either, eligible or can collect in the near future.

What’s clear is 65% of baby boomers, either, strongly or somewhat agree the program won’t be there when they retire. For more thoughts on this, see Future of Social Security.

How to Overcome

This is one of those things you have little or no control over. There’s lots of speculation what could happen, it’s anyone’s guess. Expect changes to be made and, hopefully, you’ve enough set aside you’ll be okay.

#3. Declining Health That Requires Long-Term Care

Medical expenses have always been a wildcard, especially when it comes to long-term care. In fact, 49% of retirees fear financial ruin if this comes to pass.

If you or your spouse requires care, your entire retirement savings might quickly be used up.

How to Overcome

While you’re still in your 50’s (or younger), you might consider long-term care insurance. While not cheap, it’s a safeguard and provides peace of mind. Alternatively, you could “self-fund” by setting money aside in the event this care is ever required.

In either case, the best defense is maintaining a healthy lifestyle.

#4. Lack of Access to Affordable Healthcare

Lack of access to affordable healthcare remains one of the greatest retirement fears for many Americans. Healthcare costs have been rising for decades and the U.S. spends more, per capita, than any other country in the world.

As a result, 36% worry they won’t have access to reasonable healthcare. According to Fidelity, the average retired couple can expect to spend $295,000 on health related expenses. And that doesn’t include long-term care.

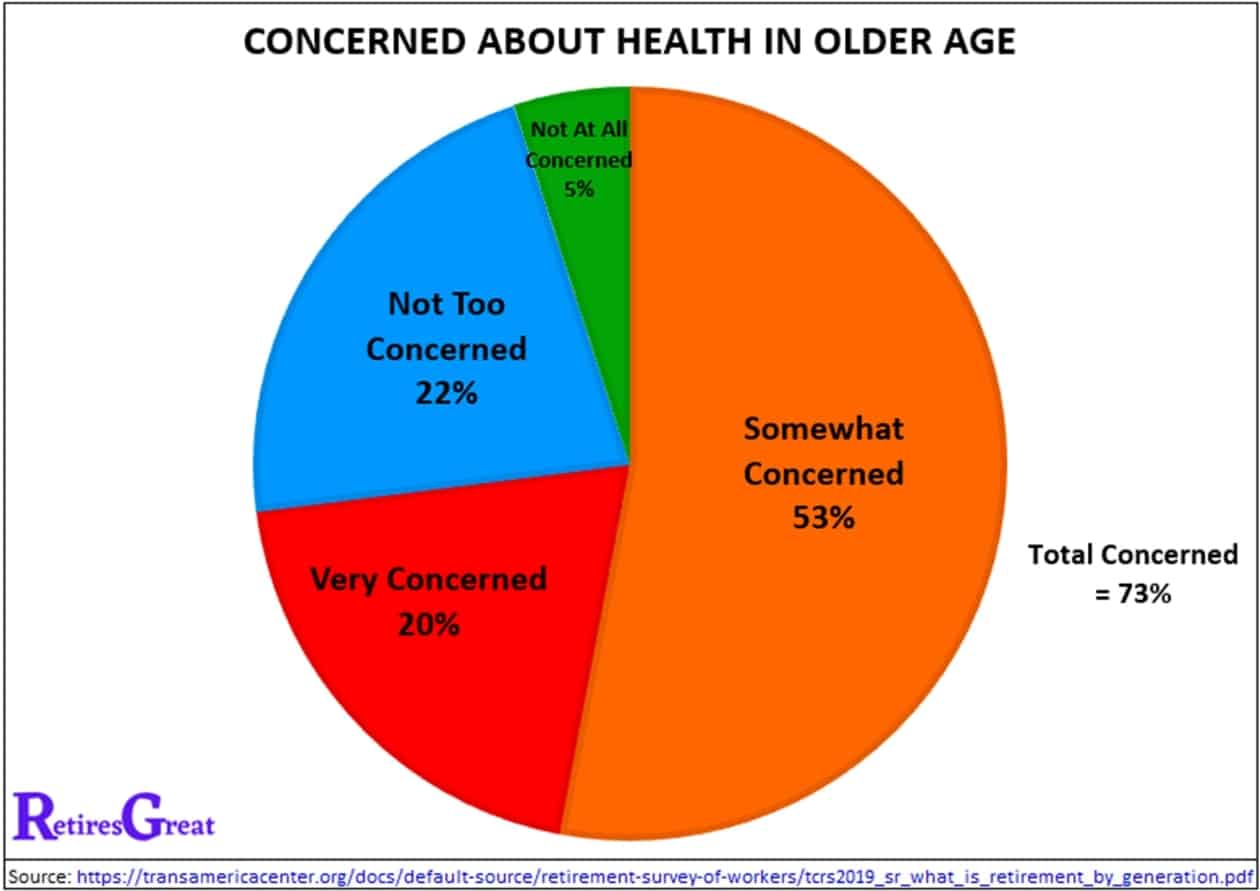

Moreover, almost 3/4 of Americans are, either, very or somewhat concerned about their health as they age. While Medicare helps (once you’re 65), by no means do your costs disappear.

You’ll still need to consider supplemental coverage for drug plans, vision, hearing and numerous other services. Also, there’ll still be copays and non-covered costs.

See our Guide to Medicare to better understand the complex array of choices that must be made when you turn 65.

How to Overcome

Everyone of us needs to deal with rising healthcare expenses. There are many options and you should check into the most cost-effective plans.

With the recent changes to the Affordable Care Act (ACA), there's some relief. Chris at Can I Retire Yet does an excellent job outlining the many cost reductions.

In addition, a health spending account (HSA) can provide a tax efficient means of setting money aside to manage future medical expenses.

#5. Cognitive Decline Such as Dementia

Something like 35% of respondents said one of their greatest retirement fears is the risk of cognitive decline. According to WebMD, the chances of becoming afflicted increase with age.

By age 60, it’s estimated 5 to 8% of adults develop some form of mental decline. Every five years, this percentage doubles. By 80, as many as half of this population have some form of dementia.

Risk factors include:

Some of these factors you have no control over. Others can be minimized with a healthier lifestyle.

How to Overcome

Assuming we survive to the ripe old age of 80 something, the statistics are sobering. A 50/50 chance at avoiding dementia isn’t exactly what I was expecting! However, that’s not quite the whole story.

By living a healthier lifestyle, many medical conditions are preventable. In addition, social engagement and keeping your mind active improve the odds in your favor.

Instead of worrying what might happen, this is the opportunity to focus on living a healthier and more fulfilling life.

#6. Unable to Meet Basic Financial Needs

Almost half of our generation have no retirement savings at all! They may have incurred setbacks such as job loss, medical expenses or helping out their children with an education.

Others may have lived paycheck-to-paycheck. Regardless of what happened, 32% of baby boomers fear they won’t be able to meet basic financial needs.

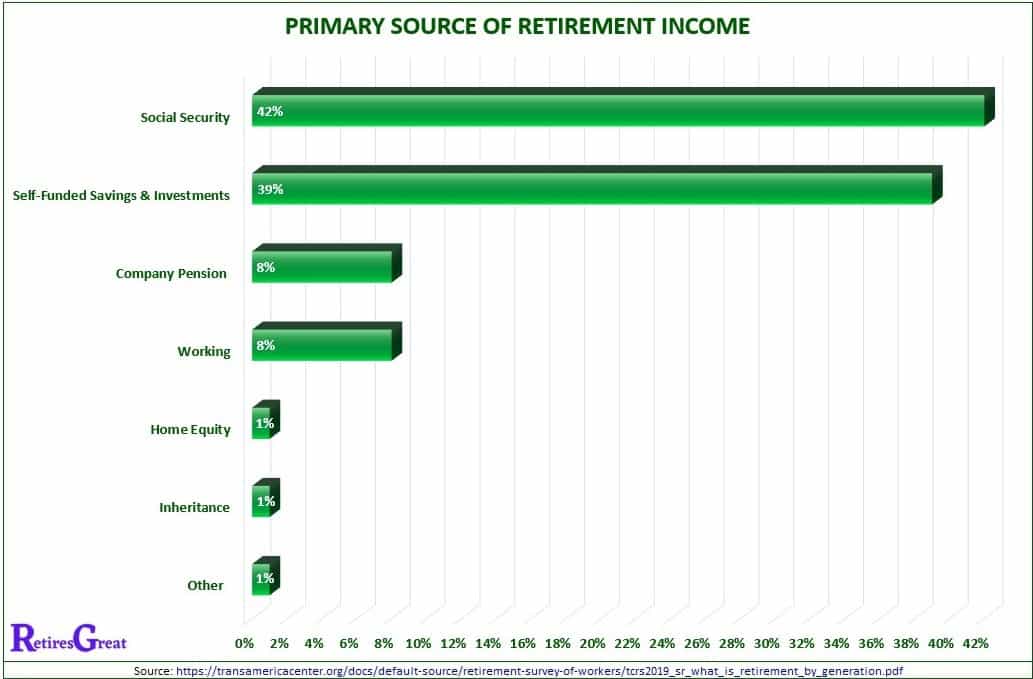

As identified, 42% of them will be dependent upon Social Security as their primary source of income.

How to Overcome

If you’re in this situation, you’ll want to keep working or, at least, find a way to supplement your income. A growing trend is for retirees to re-enter the labor force to help make ends meet.

Another option is finding a way to reduce living expenses by downsizing or relocating to a more affordable area.

#7. Finding Meaningful Ways to Spend Time and Stay Involved

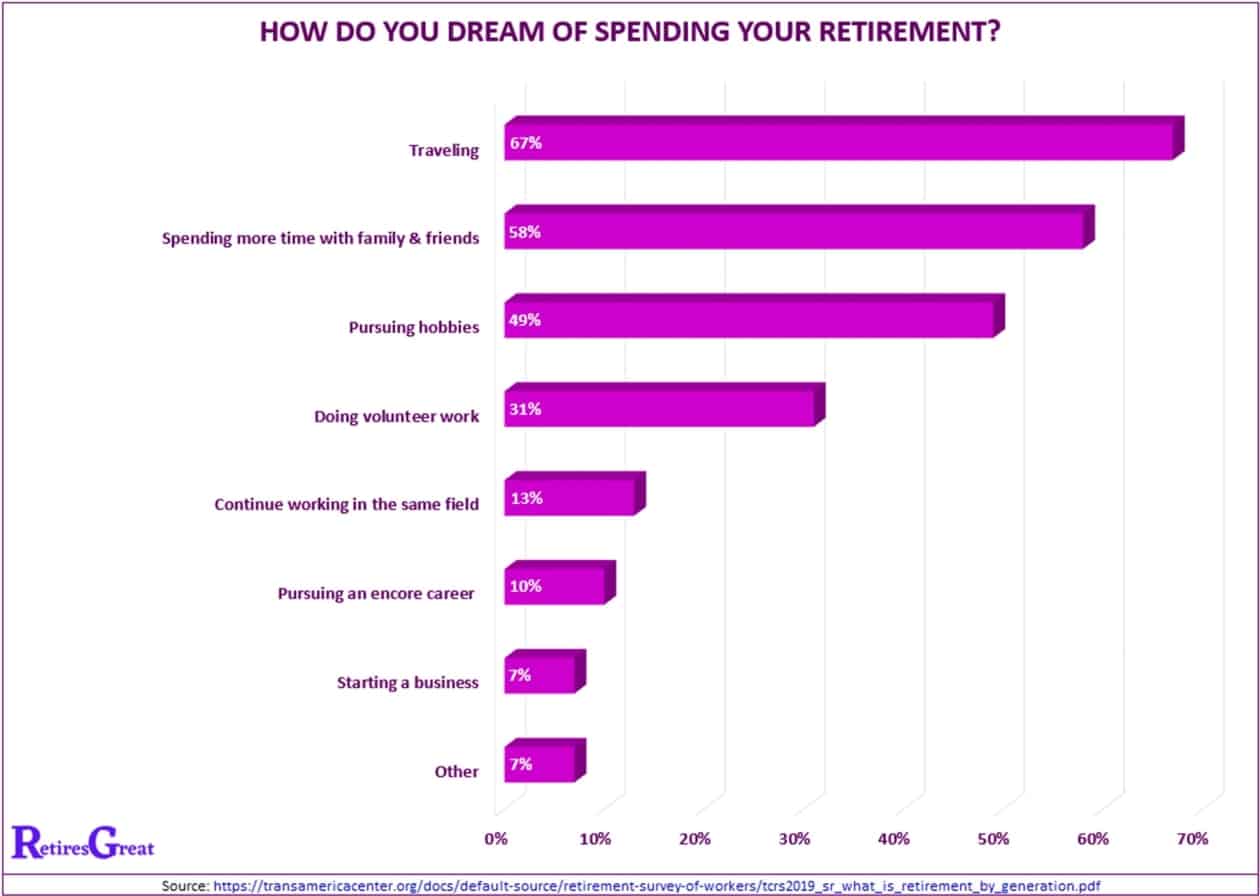

Retirement is the time to slow down and enjoy life, yet 21% of people reported fear of boredom. After a lifetime of work, they haven’t developed any interesting hobbies or outside interests. Replacing those 40+ hours of work isn’t always easy.

We’re all creatures of habit and tend to take the path of least resistance. Now, we’re watching lots more TV and lazing about. Simple chores become a big production and an entire afternoon is spent getting groceries.

Some retirees plan on traveling more. The problem, it all costs money and the average couple, at best, can only afford one decent holiday each year. They’ll probably spend more time with family and friends.

Finding a hobby or interesting activity is hit and miss. In spite of trying a few things, they never find anything that holds their interest. For instance, they signed up for a pottery class and quit after a few weeks when it got boring.

How to Overcome

One way of getting yourself motivated and staying involved is to take a more comprehensive approach. Instead of looking for one thing to do, think of it in terms of a balanced lifestyle. You’ll want to find something of interest in several areas such as:

For more information on this, see The Ultimate Guide of Things to Do When Retired and Bored.

#8. Feeling Isolated and Alone

Finally, about 15% of people fear feeling isolated and alone. Especially as we age, our ability to interact with others can become more challenging.

These could be due to health or mobility issues, hearing loss, living alone or numerous other factors. Unfortunately, loneliness can trigger feelings of isolation and even lead to depression.

How to Overcome

Maintaining a strong network of family and friends is critical for your happiness and mental health. Maybe home ownership has become a challenge and it’s time to consider a retirement community.

Somewhere where you’re be around other people and have more things to do.

Closing Thoughts on Greatest Retirement Fears

When it comes to the next twenty or thirty years of your life, you should be thinking about what it’ll look like. We’re all going to deal with challenges so now’s the time to prepare as best as you can.

If you assume everything will be wonderful, it only creates a false sense of security. That doesn’t mean to worry about everything that could go wrong.

It’s not healthy to dwell on negativity and be filled with unnecessary anxiety. Take charge of what you can and accept what's beyond your control.

Brooding or stressing over “what ifs” robs you of the happiness you deserve. Focus on making your golden years the best ever!