A typical retirement calculator spits out the number of $1.2 Million for what you need to have saved. For your average American, that is not only unrealistic, but also impossible for most of us.

It is estimated as many as 80% of people have absolutely no idea how much to save for retirement. Understand, the financial institutions are motivated to sell you their products and services.

It becomes a scare tactic to consistently overstate what your retirement savings should be. After the appalling experience of trying several of these calculators, my husband and I decided to, literally, take the bull by the horns.

Taking a no-frills approach, we did the math to determine how much you really need for a decent retirement.

The average American couple would require $430,000 in savings to comfortably retire at 62. If they choose to defer retirement until 65, their savings could be reduced to $364,000. At 67 it drops, again, to $311,000. These numbers are based on replacing 80% of their annual household income. This translates into a yearly retirement income of $48,000 until they reach the age of 85.

The following assumptions were used in our calculations:

- Annual Household Pre-Retirement Income: $60,000

- Investment Income Interest Rate: 6%

- Inflation Rate: 2%

- Social Security Cost of Living Rate Increase: 2%

Retirement Income

Unlike the retirement calculators, we focused on displaying a modest retirement plan that the average couple could achieve.

Yet, each of us is unique and your lifestyle in retirement is largely based upon how much you saved (or didn’t).

You may have additional sources of income such as a pension, rental income, or a part-time job that will further improve your financial situation.

Our calculations are based upon the average household income of $60,000 yielding an annual retirement income of $48,000.00 (80% of pre-retirement income).

This combines both you and your significant other’s savings and social security lasting until the age of 85.

For our own sanity and to keep this straightforward, we have not included expenses. The two greatest costs most retirees don’t plan for are medical issues and travel.

Health insurance and/or a health savings account is something each of us should consider. If travel is on your horizon, keep in mind that any withdrawals from your savings will affect income down the road.

Taxes are another piece of the puzzle to factor into your net income. Let’s go into more detail on the numbers we used to base our calculations.

Social Security Income

Social security is based upon your contributions over the past thirty plus years. Your exact benefits can be accessed through the Social Security Administration website.

For illustrative purposes, we used their Quick Calculator submitting an income of $30,000.00 for each person. This yielded a monthly benefit of $780.00 per person per month at age 62.

When deferred to age 65, this increased to $994.00 and $1,171.00 at age 67. Social security is indexed for inflation which means you get more money as the cost of living increases.

For simplicity, an increase of 2% per year was factored into our model (see Inflation below). Inflation will fluctuate from year to year and no one can predict exactly what it will be in the future.

Even if inflation exceeds 2%, your social security income should increase proportionally to match the current inflation rate.

Of greater concern is the viability of social security and possible reduction in benefits. Trust fund reserves are projected to be exhausted by 2037 unless changes are made.

This is largely due to our aging population with more retirees drawing upon it and a reduction in the number of people going into the workforce and contributing.

See Baby Boomer Facts for more information on this.

Life Expectancy after Retirement

One of the greatest fears is outliving our retirement savings. No one knows how long they will live which further confuses the issue of how much to save for retirement. According to the Social Security Administration, based on data compiled, the average life expectancy for a person turning 65 is:

- A man can expect to live until 84.

- A woman can expect to live until 86.4.

An average reflects that the majority of us will achieve these ages. Some will pass away prior and about one in three will live past 90. Further, about one in seven will live past 95.

In a perfect world, each of us would have a nest egg that would last until the age of 100. Realistically, 85 is a reasonable age to plan how much to save for retirement.

Inflation

Back when we were kids, a candy bar cost about ten cents. Today, that same bar typically costs a dollar or more. Inflation will continue to raise our expenses and cost of living.

What is certain is that it will continue to rise throughout our lifetime. Depending upon the source, we can expect an average 2% inflation rate increase in the foreseeable future.

For almost the past decade, we have experienced abnormally low interest rates. This means that, while money is inexpensive to borrow, it also impacts the more traditional lower risk investments.

These include bonds, treasury bills, and saving accounts that might only yield a return of one or two percent above inflation.

Return on Retirement Investments

What is your rate of return on your retirement investments? Based on Googling the question “What is the average return for a 401K”, you should receive between 5% to 8%.

To be conservative, a 6% rate of return was used in our calculations. If you get a better return, obviously, your portfolio will improve.

If your return is less than 5%, you should seriously reconsider your investments. While there is always a trade-off between risk versus return, there are many options to minimize risk even with a diversified portfolio.

Gaining expert advice and guidance might generate thousands of dollars more additional income into your retirement.

How Much to Save for Retirement?

If you ever read the book “The Wealthy Barber”, the advice was to pay yourself first and invest 10% of everything you earned. While this is a great concept, few of us have done it.

Almost everyone has had financial setbacks whether it be a bad investment, job loss, or medical costs. In addition, everyday expenses such as a home purchase, raising kids, or education costs have further strained our budgets.

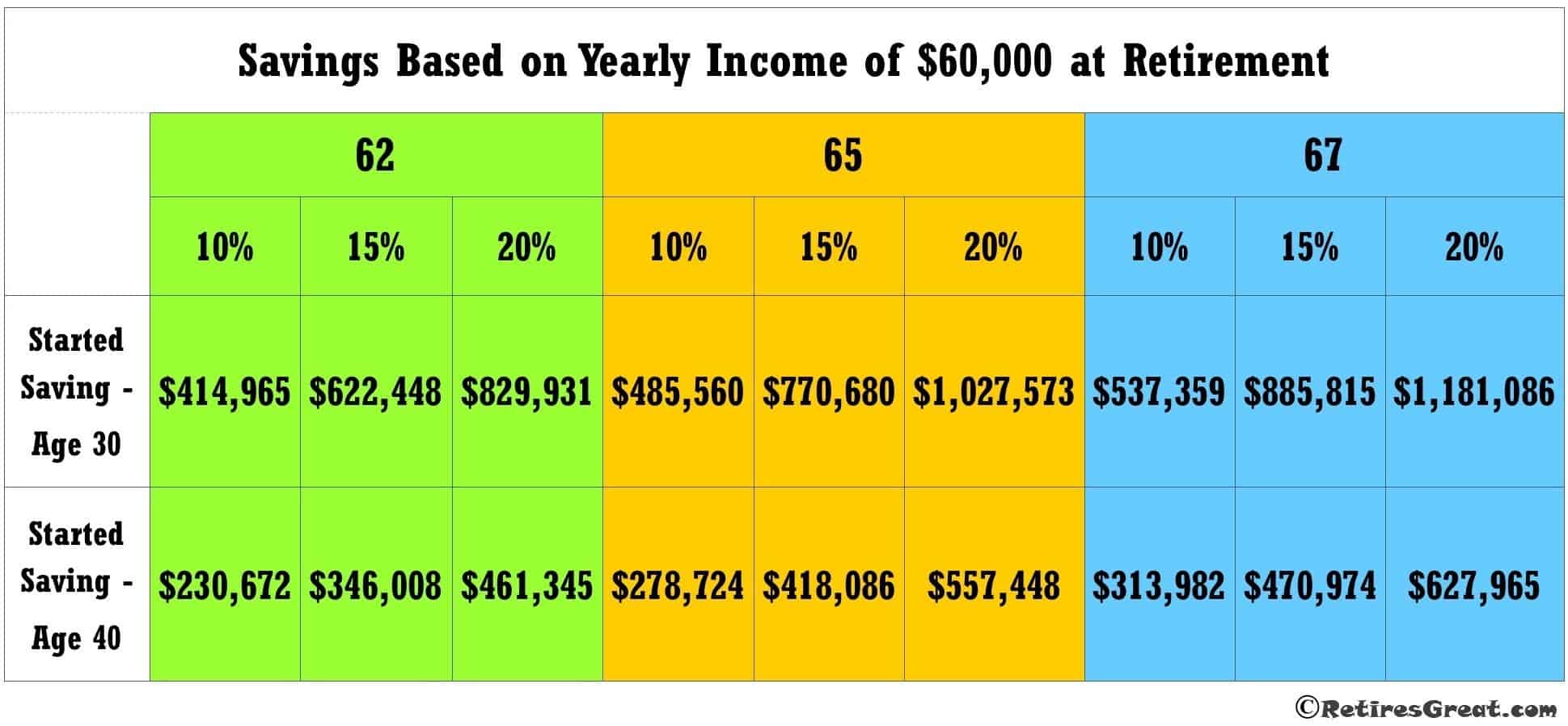

Based on our calculations, even if you had been able to save 10% of your income from the age of 30, you would still be short to retire at 62.

Your savings would be $414,865.00 instead of $430,000.00. Your options would be to work longer or live with a lower yearly retirement income.

If you did not start saving until the age of 40, the numbers at 10% become even bleaker. Effectively, 67 becomes your retirement date after you achieve $313,982.00 in savings ($311,000.00 required).

What if You Haven't Saved Enough?

Incredibly, 45% of Americans have no retirement savings at all! In 2019, the poverty level for a household of two was $16,910.00.

On social security alone, a couple retiring at age 62 would have an income of $18,720.00 at best. Thus, they would survive marginally above the poverty line.

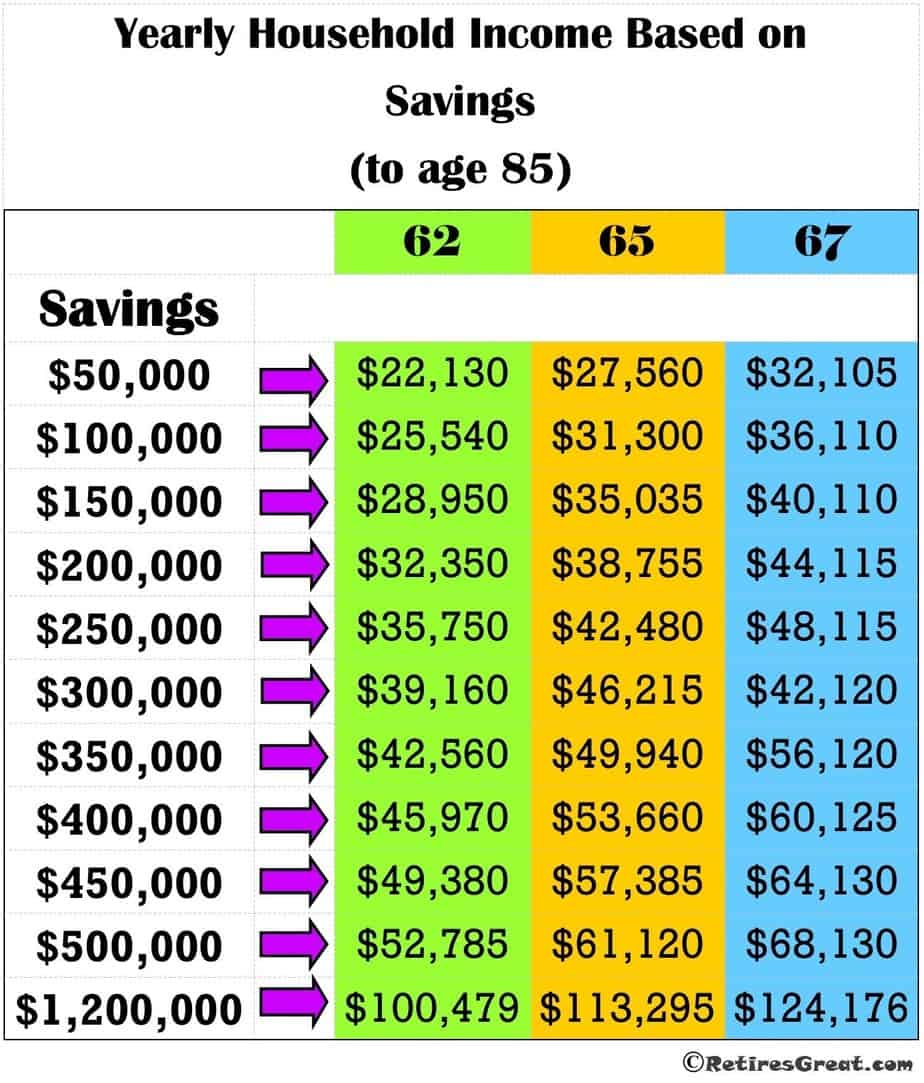

For the remaining 55% of people, about half of them have insufficient savings. For instance, a couple retiring at 62 with $100,000.00 saved, could expect a retirement income of $25,540.00 per year.

Even if they deferred retiring until 67 ($36,110.00 per year), they would still fall short of replacing 80% of their pre-retirement income.

The following table displays what your yearly household income could be subject to your savings:

Just for argument sake, let’s say you were able to save that magical $1.2 Million as some of the calculators reflect. Retiring at age 62 would yield a yearly income of $100,479!

Closing Thoughts

The fact that the majority of people do not, truly, know how much to save for retirement suggests all the calculators out there provide little or no value.

Financial institutions are big business and will continue to heavily market their products to us. Hopefully, the numbers discussed above, for an average household, can provide you with some ideas or guidelines as well as a better understanding of retirement savings.

Whether you consider it a conspiracy or not, the issue is that you need to understand your retirement savings.

Disclaimer: Retires Great provides this information purely for informational and demonstration purposes. It is not to be used or construed, in any way, as financial or professional advice. It is recommended you consult with a qualified professional adviser and review your unique situation before making any financial or other decisions.