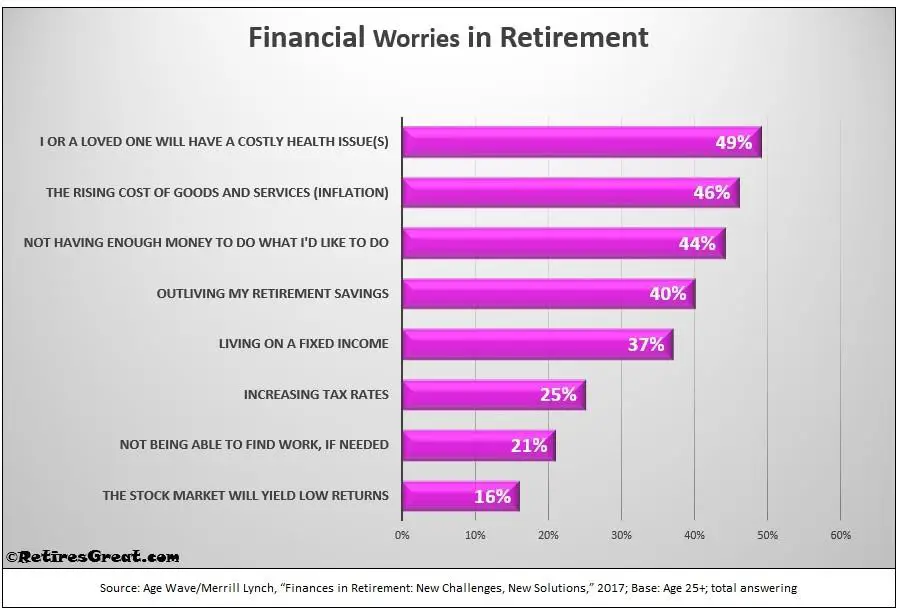

After a lifetime of working and managing daily expenses, understandably, almost everyone is unsure if they saved quite enough.

How to deal with fear of retirement and outliving your savings becomes critical to enjoy retired life. This can become a phobia considering 52% of workers are afraid they will run out of money.

Many folks postpone retiring by working a few extra years, just for insurance. Once they retire, some of them will keep worrying even if they saved enough.

Is it Normal to be Nervous about Retiring?

Absolutely, it’s completely natural to be somewhat apprehensive! Life expectancy has risen and no one can predict what the next 20-30 years will bring.

We’ve all heard horror stories or know of someone that has been wiped out and left destitute. Whether real or perceived, this is a terrifying thought when you’re about to retire.

No one wants to exist in poverty and going back to work (in your 70’s) is equally unappealing. In fact, getting a decent job becomes more difficult the older we are, especially when marketable skills have atrophied.

How to deal with fear of retirement is to acknowledge your concerns and face them head on. While it feels uncomfortable, it goes a long way to reducing nagging anxiety.

After leaving the work force, the last thing you want to be doing is to be questioning yourself. Accept you have done your best and that everything will work out. It usually does and you’ll adapt.

All we can really do is plan and hope for the best while preparing for the worst. While it’s perfectly normal to be nervous, it becomes self defeating to living in a constant state of anxiety.

How Much to Save?

The experts suggest we save 10-15% throughout our working years. If you started in your mid-twenties, each dollar you invested would grow over the years.

By the time you are 60, this should equal about 10-12 times your annual income.

Alternatively, a general rule of thumb suggests sufficient savings to support withdrawing 4% a year throughout your retired years.

An easy way to calculate this is to divide your desired annual income (say it’s $50K) by 4%. This would require savings of $1.25 million.

The reality is most people have not saved as much as they would have liked.

According to the Transamerica study, the average baby boomers savings is only about $152,000. It’s understandable why so many feel anxious about outliving their savings.

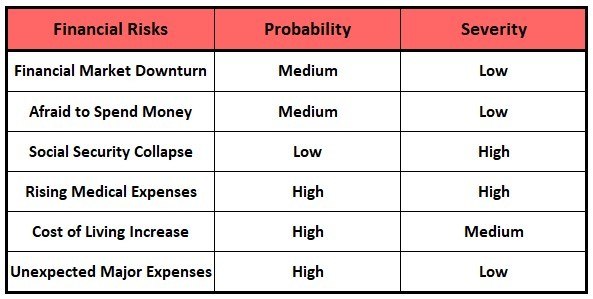

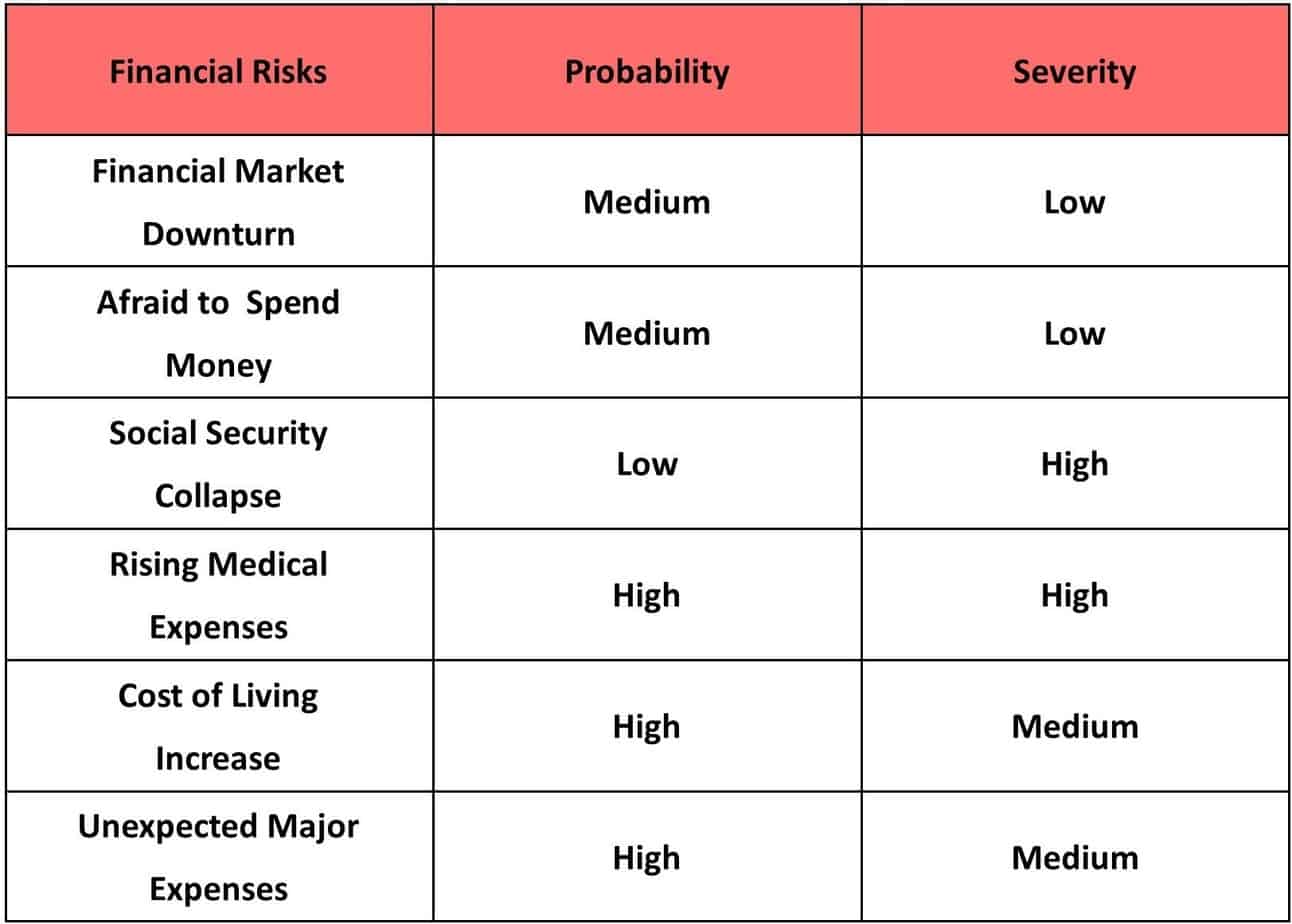

It is further compounded by the many increasing costs and risks associated when you retire such as:

How to deal with fear of retirement and minimize it is by considering the likelihood of these future expenses and how great the impact will be on your life.

Then it’s easier to plan and prepare for any outcomes.

Financial Market Downturn

There is nothing as gut wrenching as seeing your investments plummet in value! The recent onslaught of COVID-19 saw losses as high as 30% within the first months.

We’ve also observed the markets stabilizing and even recovering somewhat.

Historically, the financial markets have always fluctuated having more good years than bad. On average, over the past 90 years the S&P 500 has averaged 9.8%.

That is not to suggest all your money should be in the stock market. Rather, your portfolio should be diversified and balanced among multiple investments to minimize risk.

In addition, a healthy emergency fund is highly recommended to weather market down turns. The current pandemic shows the importance of having something stashed away for a rainy day.

There is a high probability we’ll continue to see volatility in the financial markets over the next 20-30 years. As historical evidence shows, the markets do recover after a downturn.

Thus, the severity of the risk is minimized by avoiding (when possible) withdrawing funds during these periods of change or correction.

Afraid to Spend Money

Old habits die hard! After so many years of being frugal and diligently saving, sometimes it’s difficult to spend your hard-earned money.

Even to the point that some couples refuse to take that dream vacation they always planned.

Perhaps they worry they will outlive their savings. Or, in other situations, maybe they really don’t know what they can afford to spend each year.

They never did a budget planning how to safely draw down their savings. Many of these folks might be well off, yet deprive themselves of enjoying the fruits of their labor.

These are supposed to be the best years of your life! In the words of Allan Jackson, “The Older I Get”.

This may be your chance to create a living legacy. On a Panama cruise, we met an elderly gentleman and his granddaughter who were traveling together.

He had always wanted to experience the Canal and this was a trip of a lifetime for both of them! What an opportunity to deepen the bonds between them and create new memories.

We get one “kick at the can”, why not make the most of it? Obviously, each of us needs to live within our means. Traveling and sharing time with family may be far more valuable than leaving an inheritance.

Social Security Collapse

It’s no secret that social security is under funded. The Social Security Administration forecasts trust fund reserves will be exhausted by 2035!

At that point, the estimated payroll tax contributions will only support about 75% of the benefits paid.

How this will be resolved is uncertain, especially in light of the COVID pandemic. We might see even more strain on social security as greater numbers of older workers are forced to retire.

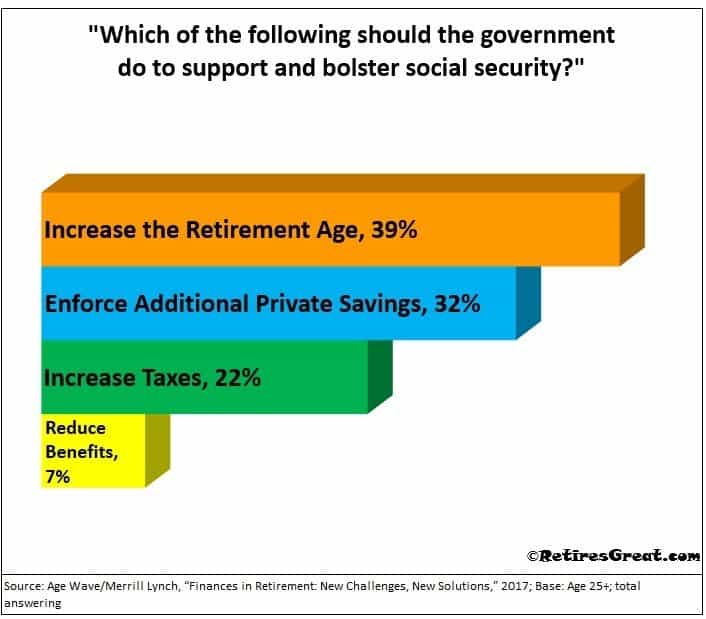

Some options might include reduced benefits, increased age of application, or higher payroll taxes. Respondents to a study by Merrill Lynch reflect reducing benefits (7%) was the least popular solution.

In my opinion, it would be political suicide to reduce benefits when so many are dependent on it. More likely would be raising the age and/or increased funding through taxes and private savings.

Rising Medical Expenses

Healthcare and exploding medical costs are another cause for concern. According to USA Today, the average 65 year old American couple can expect to pay $285,000 in out of pocket costs throughout their retired years.

That estimate was for 2019 and up $5,000 from the previous year. Also, that doesn’t include long-term care! (read more at 7 Ways to Reduce Healthcare Costs)

Keep in mind that is an average which means those that have chronic medical conditions incur more expenses than healthier people.

Fortunately, there’s lots we can do to remain healthy such as eating better, daily exercise, and getting regular check ups.

In addition, a Health Savings Account (HSA) allows pre-tax dollars to be set aside to help offset future healthcare related expenses.

Healthcare expenses will become a significant cost for each of us as we grow older. Again, instead of stressing about the future and what might be, focus on how to best manage what you have control over in the here and now.

Rising Cost of Living

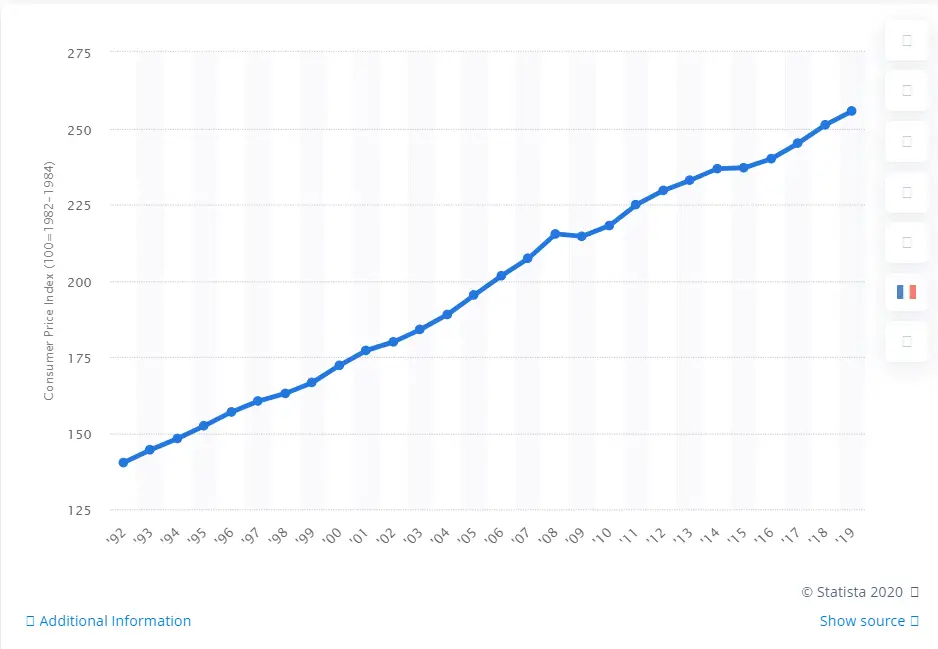

Living costs continues to rise. According to TD America, almost half (47%) of Americans believe the rising cost of living is the greatest threat to their financial security.

This is supported by an increase of 14% over the past three years.

Unfortunately, this is a fact of life and we can expect the cost of living to continue to climb. The chart below reveals how costs continue to increase.

There is a high probability this trend will remain unabated. As such, it’s a fact of life that will forever erode our future financial well being.

The best we can do is keep a close watch on our expenses and minimize them where and when we, realistically, can.

This is, yet, another way on how to deal with fear of retirement.

Unexpected Major Expenses

As if it wasn’t exasperating enough to be hit by a major expense when we were working, at least we had a pay check and could recover over time.

Unless you’ve set aside an emergency fund, any unexpected costs will likely come out of your savings. Home ownership is typically one of the largest ongoing expenses.

You can budget for property taxes, insurance, utilities, and general maintenance. Just when you think everything’s under control, things go awry.

It’s just part of life, but did you notice bad things always seems to happen in threes (Murphy’s Law)? For me, it goes something like this:

At least that’s my experience! It never rains, but it pours. Then everything’s good for a while – you hope.

Oh well, it’s only money, right!? In the famous words of the iconic Doris Day, “Que Sera, Sera (Whatever will be, Will be”).

Bottom line, having an emergency fund to cover unexpected costs when you least expect them is the best way to combat this worry.

Closing Thoughts on How to Deal with Fear of Retirement

It requires accepting you will have setbacks and be making adjustments on the fly.

Outliving our savings is the most common one, afflicting about half of us. It is not really surprising when you consider all the future expenses in store for each of us over the next 20-30 years.

Rather than feeling anxious over what might happen, remind yourself this is your life and you deserve happiness. The bad times pass. The good times come again.

Take everything in stride and count your blessings. After all, these are the best years of your life so you should enjoy them!