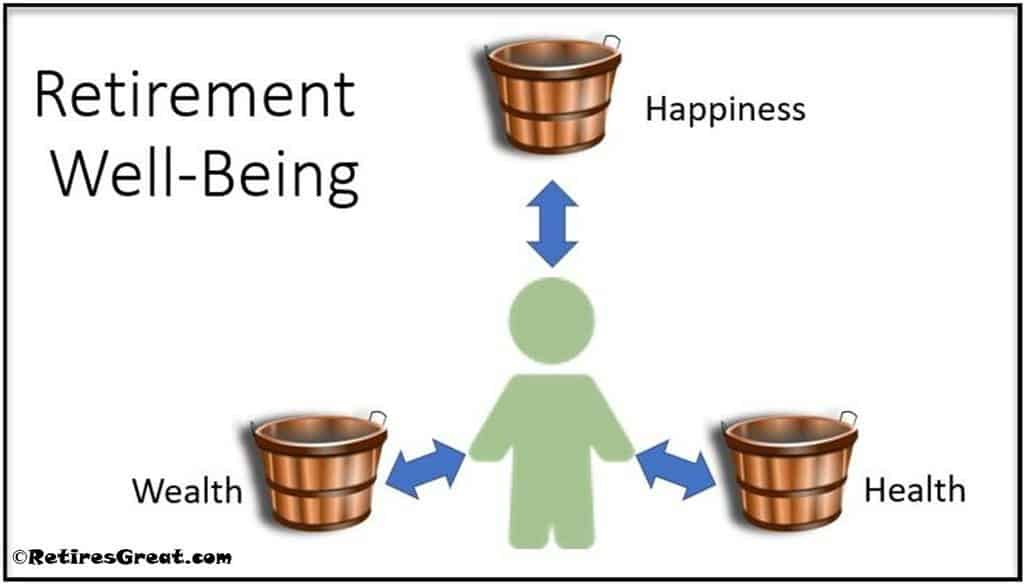

The keys to improve your retirement well-being are achieving a solid financial base, maintaining good health, and experiencing happiness. The real secret is sufficient abundance in each of these areas promoting balance and harmony.

The glaring reality is a shortage of any one of these areas will negatively influence your overall contentment. These problems can be real or perceived.

For instance, you may question if you saved enough when, in fact, you have more than enough for a comfortable lifestyle.

Yet, if you perceive you’re short, you will live as if you have financial scarcity.

What Exactly is Well-Being?

According to Dictionary.com, it is defined as:

“a good or satisfactory condition of existence; a state characterized by health, happiness, and prosperity”

We can think of each aspect as a bucket that is, ideally, full to the brim. While the quantity is subjective, the most important aspect is each is sufficiently full to meet your needs.

When there is scarcity in any one of these buckets, it will reduce your overall retirement well-being. Some examples:

Each of these buckets needs to have sufficient quantity to maintain balance.

How Much Money Do You Really Need?

I’m sure everyone thinks more is better. But, at what cost?

The trade-off of those extra years of employment versus the freedom to fully enjoy life. Especially if you don’t particularly enjoy your job, what is the opportunity cost?

Let’s get to it; how much money do you really need?

How Much Money Is Enough

To be completely frank, if your nest egg looks like it came from a hummingbird, you're likely a little shy in your savings. Instead of retiring to enjoy your best years, this shortfall will detract from your overall retirement well-being.

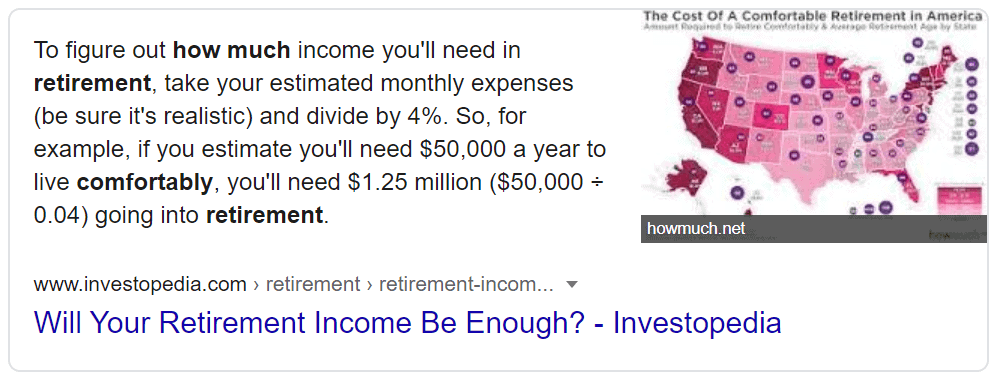

One rule of thumb is to divide your estimated monthly expenses by 4%. Thus, if $40,000 a year would provide you with a comfortable lifestyle, that means saving about a million dollars.

That’s not the whole story though. How much you really need is completely dependent upon your unique situation. Some considerations include:

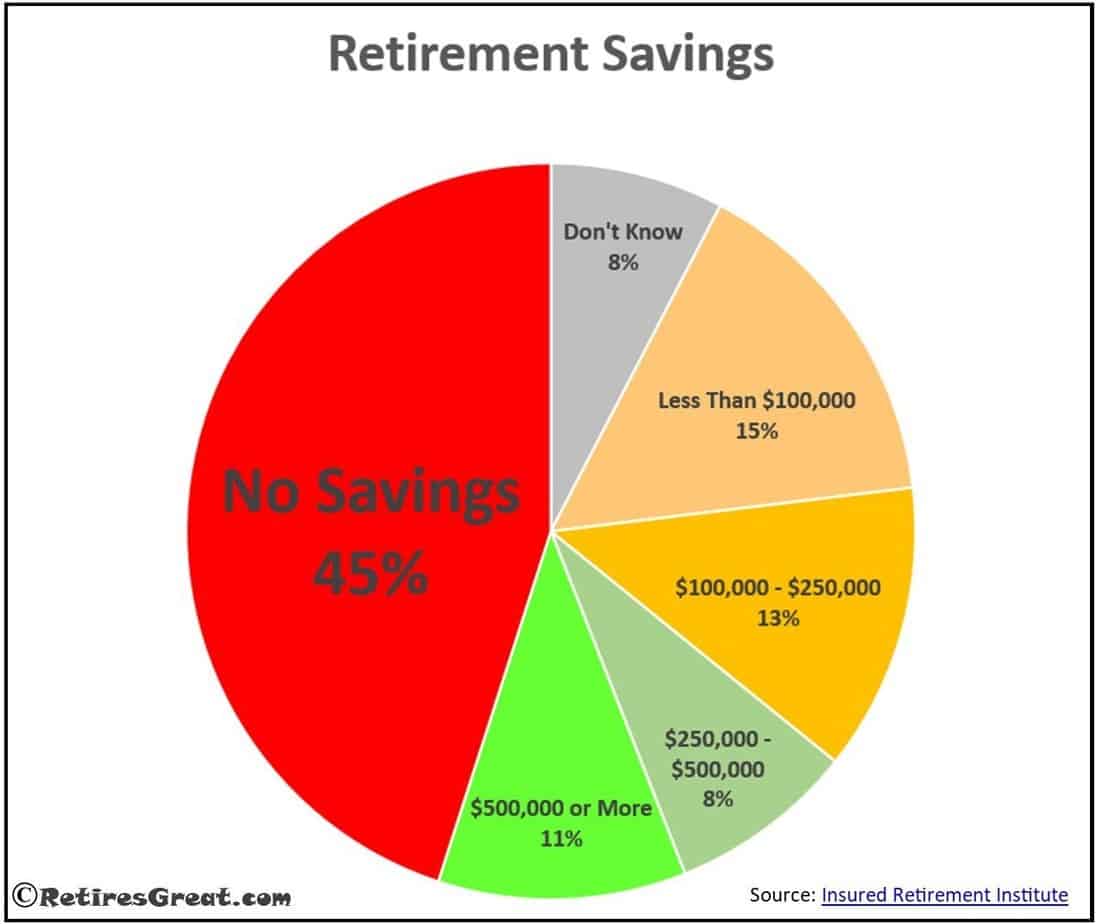

The “elephant in the room” question, what if you’re behind on savings? As many as 3/4 of Americans haven’t properly prepared financially.

Some of your options include:

Just for argument sake, let’s say someone earned a six-figure salary, spent freely throughout their working days, and didn’t set aside as much as they should have.

Hate to say it – they’re in for a shock and a massive lifestyle change! Discipline is required to live within our means and prevent overspending.

For those that are unable to rein their spending in, they will feel scarcity and unhappiness. They will always be behind the eight ball.

Financial Fears

As we noted, the majority of us could have done better at preparing financially. Compounding this issue is stressing and fretting about what the future will hold.

Worrying about the lack of money is one of the most sure-fire ways to suck enjoyment out of life. The pandemic has created immense fluctuations in the stock market. Your investments may have declined in value 20-30%.

The markets are like an out of control yo-yo that no one can predict. This induces a great deal of fear and uncertainty about our portfolios and future financial health.

At the other extreme, are those that have spent a lifetime of frugality and financially prepared. Fretting about money and if they saved enough. Regardless of how much they accumulated, they still feel insecure.

These folks might even extend their working years, just in case, you know.

When they do retire, old habits die hard and they squeeze each and every nickel for the rest of their lives. They never take the opportunity to enjoy their hard-earned dollars.

All these fears generate stress and anxiety. These in turn, can affect our health and happiness if we allow them.

Debbie's Financial Story

Almost everyone has had a bad boss at some point. There’s not much anyone can do about it other than suck it up or get another job.

Once we are in our 50’s (or older), its not quite as easy finding another job. This is the story of my wife, Debbie, one year ago and how she retired.

First of all, Debbie is a consummate professional taking great pride in her work and excelling in all she does.

For four years, the office ran smoothly like a smooth-running machine. The last three years became a chaotic hot mess!

Her new boss thought he knew everything, was incredibly lazy, and worse of all, was completely incompetent.

Everything began to deteriorate from the get go becoming unbearable by the time she finally left.

Soon Debbie was doing the majority of his job (plus her own), while he took all the credit.

Anything that fell off the rails became her fault. He marginalized her at every turn masking his own inadequacies.

In hindsight, she should have started looking for another job. Easier said than done when your self-confidence is shredded on a daily basis.

Plus, the pay was decent and Debbie wanted to contribute to our household expenses.

She sucked it up even though it became more and more difficult to drag herself into work. She dreaded going to work, her days were misery, and her health began to decline.

After three years of this idiocy, everything came to a head on that fateful Friday afternoon.

He decided to, once and for all, put her in her place by formally “writing-her-up” over a trivial matter.

How screwed up is that!?

Monday morning, she submitted her resignation and officially retired. Life is too short to drag yourself to a job you hate.

Do we miss her income, without a doubt!

Yet, our financial bucket was sufficiently full (after a lifetime of work) to support a comfortable lifestyle. We are content and grateful for what we have.

Related Post: Bad Boss | My Journey to Hell and Back

Health During Your Retired Years

While most of us tend to take health for granted, acting proactively pays major dividends. By that I mean, many diseases and medical conditions are preventable or made less invasive.

Regular exercise and proper diet can make a massive difference in your existing and future health. The “health bucket” is critical to your quality of life. When low, it impacts your happiness and, ultimately, your pocket book.

How Money Impacts Health

According to Fidelity, the average 65-year-old couple will spend about $285,000 on medical care and expenses throughout their retired years. That doesn’t even include long-term care!

Low income can have negative consequences on health. For instance, those with insufficient money are susceptible to:

Improving Your Health is an Investment

Everyone knows their health is important, yet why do so many of us neglect it?

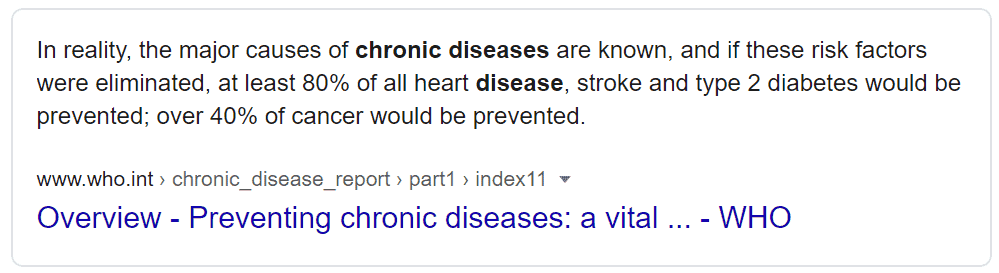

Did you know that improving your health can prevent up to 80% of chronic diseases?

Moreover, about 85% of all healthcare costs are incurred treating those with chronic diseases.

Related Post: 7 Ways to Reduce Healthcare Costs

Debbie's Health Story

Although neither of us realized quite how bad it had become, her health was spiraling downward. All the stress and anxieties of work were wreaking havoc with her body and mind.

In short, her job was killing her! One year later, not only happier, she is also much healthier.

Escaping from that toxic environment transformed everything. Her mental outlook, healthy eating, and incorporating physical activity into each day has transformed her.

I’m proud to say my wife’s a brand-new woman!

Happiness in Retirement

Happiness is the most subjective and least understood of the three buckets. Seriously, how do you even measure it? The bigger question, how can you be happy throughout your retired years?

Your happiness (or lack thereof) is largely dependent upon your mindset and attitude. Whatever you perceive will impact how you feel.

If you believe you are hard done by and life is unfair, your happiness level is likely dismal.

With a positive attitude, you open yourself to finding the good things in life. You create opportunities to succeed and more easily bounce back from setbacks.

The best part, each of us has complete control of our mindset, if we so choose.

What Makes You Happy?

Everyone wants to be happy, it’s so much nicer than the alternative. So, what makes you happy? Think back to one of the happiest times in your life.

For myself, my university days might have been one of the happiest periods of my life. Although I was too busy to even consider such thoughts back then.

The academic studies were all-consuming grappling with an onslaught of information to absorb, papers to write, and preparing for the next imminent exam.

Like a treadmill on steroids, there was never quite enough time to keep up.

Fortunately, I was able to avoid student loans through my part-time job at Safeway.

That chewed up about 20 hours a week working evenings and weekends.

On top of all that, I met my first serious girlfriend. Those four years were a blur and I’m not sure how I even managed it.

Yet, it was an immensely satisfying and rewarding time in my life.

Take a moment, think back to one of the happiest times of your life and why you were happy.

What Exactly is Happiness?

Happiness is a “state of mind” when you feel satisfied, fulfilled, and almost everything seems to fall into place.

Using my example from above, why is it we are often oblivious to how happy we were and didn’t realize it? At least, until we look back.

Just to further confuse everything, joy and euphoria are extreme emotions. These are wondrous feelings we associate with happiness.

Unfortunately, they’re not sustainable and are more like a short-term shot in the arm. About once a year, my wife and I splurge on a vacation. Something special where we spoil ourselves and have a good time.

We also recognize that, for us, it is only one small piece of the happiness in our lives. According to Positive Psychology, happiness is the state of feeling pleasure or contentment. The important points include:

Achieving Lasting Happiness

Interestingly, happiness isn’t a goal you can set out and achieve. Rather it’s more of a by-product of how we perceive the world around us. It is a state of mind to embrace.

For example, purchasing tickets to your local dinner theater (or concert) makes for a great evening out. The effect is short-lived and doesn’t promote lasting happiness.

As fun as it might be, some folks depend on such events to feel happy. Money buys happiness for them, masking the real issue of finding sustainable happiness.

Further to that, a negative mindset suppresses happiness. Maybe the theater performance wasn’t so great to the point that it felt like a waste of money.

Nothing is ever good enough for these individuals as they’re always looking for what is wrong.

Other Factors that Influence Happiness

As noted above, a positive outlook is a major factor in finding happiness. In fact, your attitude and mindset might be the only thing you have complete control over.

Other contributing aspects include:

Closing Thoughts on Retirement Well-Being

Just as in life, improving peace and contentment requires balance and sufficient abundance of the things that are most important to you.

These can be broken into three categories: wealth, health, and happiness. When there is scarcity in any one of these buckets, overall happiness is diminished.

Another key consideration is how much each of us believes we need in these respective buckets. It’s somewhat subjective depending upon your perceptions and the lifestyle you wish to achieve.

With a positive mindset, our focus refines as to the quantity and quality of those things we hold most dear. Maybe more wealth isn’t as important as better relationships, better health and enjoying life.

Finally, when we are content and grateful for everything we do have, life just seems better.