A living will (also referred to as an advance directive) helps you gain inner peace by coming to terms with your own mortality. For most of us, it’s unpleasant to think about how life events might unfold.

So, at a subconscious level, this creates anxiety and fear of the unknown and the future. By discussing and documenting your medical wishes, you gain peace of mind knowing that you've prepared, as best as you can, for the future.

This document expresses your wishes for medical care in the event you're no longer able to make these decisions. And, it only comes into effect when and if this happens.

As a legal document, it empowers someone you trust to ensure your wishes and desires are honored. Even when circumstances arise that haven't been considered, they'll make decisions that are in your best interest.

Without one, these matters are left open to interpretation by family members and health care professionals. As a result, there's no assurance that your wishes are going to be met or even followed.

Her entire world collapsed with that call from the hospital. Overwhelmed by the news, Barb fought back the tears as she frantically prepared to leave. First, she let her husband know that her mother had a stroke and the prognosis could go either way. Barb had no idea how long she'd be away.

It was a four-hour drive. She would call her work and brother once she was on the road. After dad passed away almost three years ago, mom had become frustratingly stubborn and refused to discuss anything about her affairs. Even worse, she was becoming more forgetful and Barb was concerned it may be the onset of dementia. It seemed all mom wanted to do was live out her years surrounded by her memories.

After several exasperating go-rounds with mom, Barb had finally given up. Now, she wishes she had pressed harder for her to get her affairs in order. She didn’t even know if mom had a will, let alone a medical directive! Even if mom pulled through, she surely would need to go into extended care. The house would have to be sold and she knew that her brother’s wife would be all over anything of value. This was going to be a mess and might even wind up in court. She prayed that, somehow, mom would make a miraculous recovery.

Disclaimer

This is not legal advice and is intended for informational purposes only.

Why It's Important to Take Care of Your Affairs Ahead of Time

The situation described above illustrates the need for you to have your affairs in order. Without this document, decisions could be made that you may not otherwise make for yourself.

For instance, depending upon the severity of Barb’s mother’s stroke, the hospital may have her on a breathing ventilator and feeding tube (intubated).

If she shows no signs of recovery she would, effectively, languish on life support. Such an event can become emotionally charged between family members with conflict erupting as to the best course of action (or no action).

Your living will provides clarity and direction for family members and healthcare professionals as to your wishes.

Most of us assume that our loved ones are going to ensure the decisions they make are in our best interests. In a perfect world, there would be no need for an advance directive.

In a perfect world, there would be no need for an advance directive. The reality is, when medical situations arise, they are often emotionally laden with differing opinions among family members.

Without family consensus, the medical community is obligated to continue to preserve life using all reasonable treatment.

As much as no one likes to contemplate what might happen to them, legally documenting your wishes can greatly minimize family strife and indecision.

In the absence of a living will, last testament and / or other legal documents, it's possible for your family to apply for guardianship through the courts.

Unfortunately, the process is complex, can take months and cost thousands in legal fees. Even worse, the person appointed, may not be who you would've chosen.

When things wind up in court, it can create further conflict and delay especially if contested by other family members.

What is a Living Will?

So, what's a medical directive, exactly? It's a legal document(s) empowering someone you've given the authority to make decisions on your behalf.

This includes only non-financial personal matters such as health care, medical treatment and / or housing. And, it's recommended that everyone over the age of 18 create an advance directive.

Depending upon your jurisdiction, it can also be referred to as an advance healthcare directive, personal directive, durable power of attorney for healthcare or medical directive.

The person(s) you entrust to make these decisions may be referred to as an agent, healthcare agent, healthcare proxy, healthcare surrogate or healthcare representative.

Choosing Your Agent(s) Wisely

Your agent(s) can be almost anyone you want, as long as they agree to accept the responsibility and are over the age of 18. Family members, close friends or lawyers could all be potential candidates.

In some situations, it's appropriate to have it be a paid position (as opposed to volunteer). Regardless of whom you designate as your health care agent(s), it's not a decision to be taken lightly.

Possibly, at some point they may need to make a life ending / altering decision on your behalf. There should be in-depth discussions and documentation of your wishes with your agent(s).

Your personal directive only takes effect in the event you're no longer deemed to have the mental capacity to make decisions for yourself.

Due to the nature of advance directives, decades may pass before it's invoked or, hopefully, never at all. If you're married, it would seem logical for your spouse to be named as your agent.

Unfortunately, as the years pass, your partner may become infirm, you might outlive them or you could divorce / remarry. For this reason, it's recommended to select more than one agent.

If you have children, are you comfortable they would make the best decisions for you? Consideration needs to be given to outside influences such as a daughter-in-law or son-in-law.

When multiple agents are selected, there's a high probability they'll disagree at some point. If viable, it might be desirable to consider having three agents as a means of resolving disagreements (majority rules).

Another option is to designate only one person as the primary agent and the other(s) as alternates.

Advance Directive Discussions

Such a discussion isn't going to be easy nor pleasant. There are numerous aspects that should be reviewed. Certainly, you'll want to discuss them with your agent(s) and your doctor.

Keep in mind that medical technology is rapidly advancing and new treatment options are going to become available that aren't even fathomed today.

Also, if your wishes run counter to medical ethical practices, a doctor has the authority to override your wishes. Some factors to consider include:

- Religious beliefs such as no blood transfusions or preserving life as long as possible (and / or under what conditions?)

- Where would you prefer to reside - perhaps at home? However, at some point, you may require assisted living accommodation or even a nursing home. Geographically, do you want to be in a facility close to a son or daughter?

- Level of treatment, for instance active cancer treatment as opposed to just making you comfortable.

- Quality of life including invasive treatments such as dialysis, feeding tubes and / or ventilators.

- At what point, if any, would you want a Do Not Resuscitate (DNR) order?

What Does a Medical Directive Cost?

You basically have two options. The first is to retain a lawyer, likely costing anywhere from $200.00 to $500.00, to prepare your personal directive.

This ensures State laws are complied with and they can offer thoughts and opinions to ensure your wishes are followed.

In addition, you may choose to have them complete all additional legal documents such as your last testament, durable power of attorney for health care, and a durable power of attorney for finances.

This ensures all your affairs are properly managed and in order. In more complex situations such as the onslaught of Alzheimer’s disease or dementia, a lawyer is highly recommended.

As a second option, it may be feasible to do it yourself. Online forms are available however you'll need to ensure they're properly witnessed and notarized once completed.

Expect to pay $45.00 to $75.00 for this type of advance directive. The DIY approach is appropriate for straight forward situations when you've taken the time to ensure everything is properly recorded and documented.

What to Do with Your Durable Power of Attorney for Healthcare?

Believe it or not, some people put their living will into a safety deposit box that no one else has access to!

While a safety deposit box may be appropriate for a last will and testament (someone should still have access), your advance directive needs to be filed with your health care provider and, preferably, discussed with your doctor.

There may even be an online repository where it can be stored electronically. Each agent and yourself should have an original that's stored in a secure place.

This might be in a home safe, safety deposit box or any other secure location such as with a lawyer. If anything changes, you'll want to update it and have any and all old versions destroyed.

It's best to communicate that to anyone concerned, the document has been updated / changed. Examples could include if you divorce, remarry or desire to change agent(s).

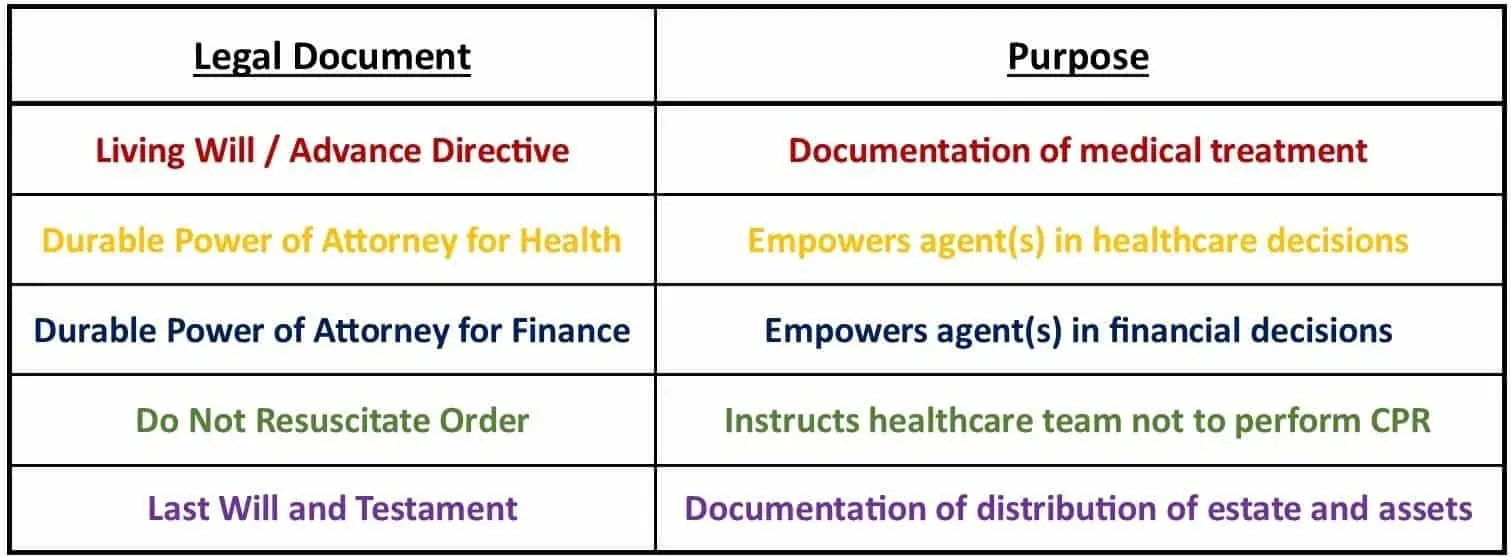

Related Legal Documents

Your medical directive only encompasses health matters. It doesn't authorize any financial decisions.

For this reason, it may be in your best interest to create a durable power of attorney for finance so that person can act on your behalf addressing any financial implications or decisions.

For example, if Barb’s mother doesn't regain mental capacity, it'll become complicated. Barb and her brother can't sell the house (even if they're the legal heirs named) at which point they'll go through court applications to apply for guardianship first.

Difference Between a Medical Advance Directive and a Durable Power of Attorney for Finances

A medical advance directive documents your wishes for medical treatment to be enacted at such time you're unable to make these decisions for yourself.

Depending upon state laws, this can be called a durable power of attorney for healthcare which, also, designates a healthcare agent(s) to oversee your welfare.

A durable power of attorney for finances complements the durable power of attorney for healthcare by empowering the agent(s) to conduct financial decisions on your behalf.

These two conditions only apply after you've been deemed incapable to make decisions for yourself.

Difference Between an Advance Directive and a DNR Order

A Do Not Resuscitate Order (DNR) may be documented within an advance directive and requested when a certain condition or situation occurs.

For example, you are near end-of-life with a terminal disease and don't want to be revived. Your agent would notify the medical team not to do cardiopulmonary resuscitation (CPR) if your heart or breathing stops.

Your agent would notify the medical team not to do cardiopulmonary resuscitation (CPR) if your heart or breathing stops. This would need to be signed off by a doctor and put on your medical chart.

If you still have mental capacity, you could request the medical team not to resuscitate you. The doctor would still need to sign off on it and add it to your chart.

Difference Between Personal Directive and a Last Will

A personal / advance directive is in effect while you're alive and able to provide guidance on your healthcare wishes.

Your last will and testament takes effect only after your death, identifying how you want your estate and assets distributed. Also, it may identify funeral / burial arrangements, gifts to be given, etc.

Special Alert: Alzheimer's and Dementia

Especially with a family history or signs of Alzheimer’s / dementia, it becomes critical to have your affairs in order. To date, there are many treatment options, but as of yet no cures.

An estimated 5.8 million Americans are diagnosed with Alzheimer’s disease and other forms of dementia. And these numbers are rapidly growing!

According to the Alzheimer’s Association, it's become the sixth-leading cause of death in the United States. In fact, one in three seniors die from it.

Alarming statistics reflect that those with Alzheimer’s are almost two-thirds female. In addition, older African-Americans are about twice as likely to have it compared with older whites.

Alzheimer's and Dementia

One in three seniors die from Alzheimer's and/or other forms of dementia.

In 2019, the estimated cost to the healthcare system is going to be $290 billion. Without a cure, this could rise as high as $1.1 trillion by 2050.

The human cost is equally enormous with around 16 million Americans currently providing unpaid care for loved ones.

According to Bankrate, there are numerous care considerations that need to be planned, and options on how to manage these costs.

These diseases are progressive leading to cognitive decline. Without getting your affairs in order, it becomes an even further struggle for you and your family.

Closing Thoughts

While few people look forward to preparing a medical directive and other legal documents, they are truly important.

Getting your affairs in order provides greater inner peace for you through acceptance of your own mortality and knowing you have some say in your life decisions.

Additionally, this reduces the potentially emotional heavy burden on family members. Truth be told, no one ever cheats death. What we can do is prepare and better manage our last days on our own terms.