When the day comes and you finally retire, the sky’s the limit when it comes to deciding where to live. You might want to stay put or maybe you’re more adventurous and want to try the expat life for a while.

Everyone has their owns wants and needs. So, you need to think what are your retirement location criteria. And what are the deal breakers that make a place a definite no. It’s not easy and requires some serious thought.

The last thing you want to do is pull up stakes, move somewhere and then find out you absolutely hate it! We’re having those discussions right now ourselves. We have to figure out what’s important and necessary and what we can live without.

We’ve put together a list of the factors that we believe are important considerations.

1. Flexibility and Recognizing Your Needs Will Change

First and foremost, all of our needs change over time. Flexibility requires planning for your current needs while considering longer-term requirements.

Many retirees plan on remaining in their homes. Especially when their mortgage is paid off and they’re comfortable with their house and neighborhood.

Having said that, things may change over time. Regular maintenance and upgrades will need to be done. Over time, these could become more difficult to manage or become major expenses.

Many of these folks will find themselves “house poor” and looking to downsize.

Retirement also provides the opportunity to live anywhere you want. Maybe a more temperate climate with the option of strolling on a beach every day. Many retire in other countries and report living comfortable for a fraction of the cost.

Yet, at some point, most expats are ready to return home. They miss family and friends or health issues arise. The reality is most of us will need to adapt as we get older.

Our Challenge

My wife and I greatly enjoy our rural property and the sense of calm it affords. Four acres of nature to putter about in, a godsend during the pandemic.

However, I’m beginning to question if I want to be doing so much yard work. We want to start traveling more. For instance, we’d love to winter in Greece, Portugal or Costa Rica while we’re still healthy enough to enjoy it.

For us, that means moving to a place with minimal maintenance. In our post, Pros and Cons of Downsizing, we share some of the challenges and all the stuff I’ve accumulated over the years.

One of my greatest concerns is getting rid of things I might later regret. This could entail downsizing to something more manageable, better access to medical care or even an assisted living facility.

2. Agreement With Your Spouse

The second most important of the retirement location criteria is alignment with your partner. If you’re not on the same page, in all likelihood neither of you’ll be happy.

In most cases, each of you’ll need to compromise to some degree to find a happy balance.

For instance, you might want to be near family whereas your spouse prefers something entirely different. We chronical such a scenario in our post Where to Live in Retirement and the criticalness of coming to a mutual choice.

Our Challenge

We’re going through this process ourselves which largely prompted this post. Naively, I assumed we were completely aligned, especially after all the stuff we’ve written on retirement.

Surprisingly, the more we discussed the things, it became apparent we had somewhat different view points. My initial thought was buying an older home in a small town to renovate. Maybe even flip it for profit.

Debbie pointed out that sounded like a lot of work and was that what I wanted to be doing? Her thoughts centered around getting something maintenance free allowing us to travel. An excellent point as we talked about what we really wanted.

3. Commitments and Responsibilities

Another aspect are any commitments or responsibilities influencing your decisions. For example, spending more time with family and grandchildren. After all, they grow up so quickly and you could be missing out on those formative years.

Alternatively, an aging parent or family member might require a helping hand. I’m not suggesting becoming their primary caregiver. However, being involved in their lives might make a real difference for them.

Our Challenge

We have a somewhat unique situation. Our fur baby just turned 18 years old! Darned dog is as healthy as a horse, although experiencing “doggie dementia”. As a result, she’s anxious and ever pacing.

We do our best to avoid disrupting her routine and making her comfortable. At this stage, she wouldn’t do well in a kennel or with a dog sitter. Until her time comes, we’re keeping close to home.

4. Proximity to Family / Friends

Another of the significant retirement location criteria is maintaining contact with family and friends. These are the people most important to you and you may not want to move away. Or, this could motivate you to move closer to them.

More often than not, there’s no clear-cut answer. Let’s say your son / daughter lives in a different state. While you’d love to be closer, is that realistic? Plus, you’d likely lose touch with your friends if you moved.

Maintaining a strong social network is crucial in retirement. Even close friends move away, get sick or worse. Our post How to Make Friends shares strategies to expand and deepen your friendships.

Our Challenge

We’re sort of in that situation with numerous close friends. In fact, we’re reluctant to move too far away as some we’ve known for years. Yet, Debbie would dearly love to be close to her uncle and cousins.

Sadly, her aunt recently passed away reminding us how precious life is. The challenge is it’s about an eight-hour drive and we’re still wresting with this decision.

5. Cost of Living

Most retirees are motivated to reduce their cost of living. Throughout their working years, they may have lived in or near a large city. In retirement, they have the option to downsize to something more affordable and easier to maintain.

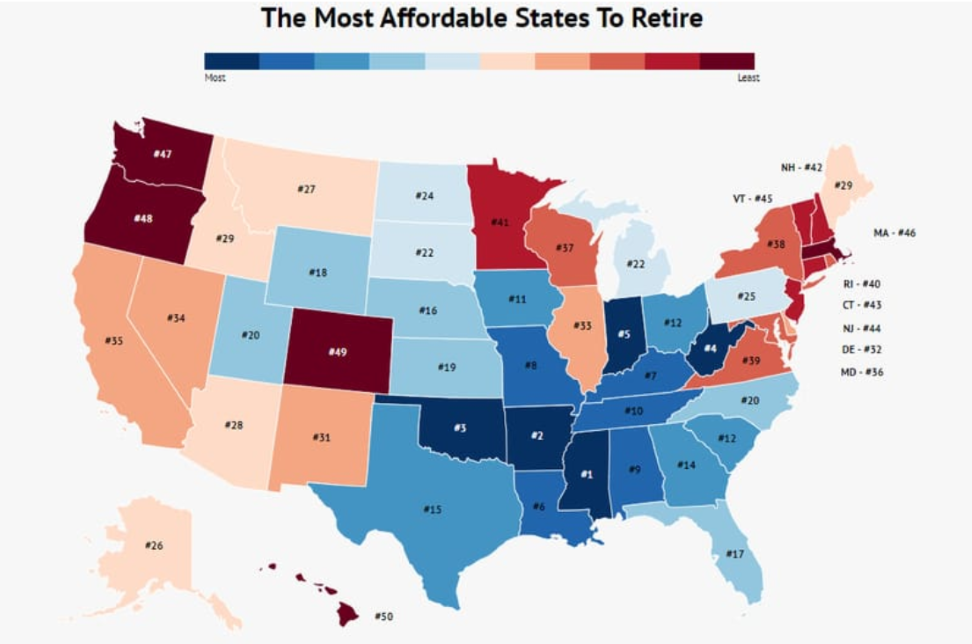

Taking this one step further, certain states offer a much lower cost of living. Relocating can help stretch your dollars. In general, the most affordable states are in the deep south. You need to also be mindful if that’s where you want to live.

In addition, 14 states don’t tax pensions or Social Security benefits which is an attractive consideration. These states include:

Many other states have limitations and / or exemptions on taxable income. If this is important to you, check out how retirement income will be taxed.

Our Challenge

Our rural property is located about 20 minutes outside a major center. We like to think we have the best of both worlds with our country lifestyle and close proximity to the city.

Unfortunately, this also means relatively high property taxes and cost of living. By moving, our living expenses would likely be reduced and it’d free up our home equity. More importantly, we’d find a location that best meets our needs.

6. Personal Safety

Another of the retirement location criteria is personal safety. I can’t think of anyone who’d choose to retire to a crime infested neighborhood. The problem is crime rates appear to be on the rise right across America.

Certain cities are notorious and according to World Population Review, the five most dangerous US cities include:

Living in one of these cities might be a little stressful. When you retire, the last thing you want to do is add more stress to your life. It’s supposed to be the time in your life you enjoy the most.

Some questions you might want to ask yourself:

So, deciding where to retire is crucial to, not only, your personal safety but peace of mind.

Our Challenge

Our personal safety is important to us. Whatever we decide will factor in local crime and how safe we’ll feel. Even our future travel options will be influenced on this.

7. Climate Considerations

Some would prefer a beach community whereas others are drawn to a mountain side retreat. Maybe it’s the beauty of the changing seasons. Whichever it is, you have the option to figure out what’s going to make you the happiest.

If you have the financial flexibility, you might choose the “snow bird” route. Wintering in a milder climate while maintaining a home base close to family and friends.

Our Challenge

When we mention our travel plans, it’s as much about escaping our long winter months as experiencing different cultures. However, that’s not for everyone.

One of Debbie’s closest friends can’t stand the heat! She’d rather be in a cooler climate even if it means bundling up for six months of the year.

To be candid, we’re also heat adverse and would suffer in the extreme summer heat of the southern states.

Plus, hurricanes, earthquakes or smoldering volcanos aren’t all that appealing. Our thoughts lean toward a more temperate climate and we’re willing to travel to achieve this.

8. Healthcare and Overall Well-Being

Access to healthcare might be one of the most overlooked aspects. With 6 out of 10 Americans living with a pre-existing condition, this should be a high priority for them. In addition, as we get older, access becomes increasingly important.

The majority of retirement communities are located in reasonable proximity to a hospital or medical facility. Obviously, not everyone wants or needs to live in such a community.

What you should be considering is your access to a doctor, dentist and any specialists to maintain your health.

Our Challenge

While I consider myself in good health, Debbie is waiting for a knee replacement. Some days those few steps in our home are painfully daunting for her.

Currently, we’re reasonably close to medical facilities and physiotherapists which will be key in her recovery.

As we consider healthcare and overall well-being important, we’ll ensure we have easy access to appropriate services. And, whichever property we eventually move to will have minimal (preferably none) steps for her to deal with.

9. Amenities

Amenities is one of those retirement location criteria also often taken for granted. This can include the local mall, box stores and anything else you like. Personal services such as your favorite hair stylist or esthetician may not be as easy to replace.

Larger centers also tend to have more things to do such as recreational facilities, dining options and cultural events. In addition, there are usually more part-time jobs or volunteer opportunities than in a small town.

Our Challenge

As mentioned above, in many respects we feel we have the best of both worlds. Downsizing to a small town will be a big adjustment for us. No longer will we be surrounded by open spaces or within half an hour from almost any imaginable service.

Recognizing this, we’re in agreement this is the right course of action for us. We’re not big shoppers or spend much on going out. Actually, one of our priorities is traveling more.

10. Travel Considerations

As many as 70% of retirees plan on traveling more. Their bucket list might consist of cross-country RV travel, visiting an exotic destination or simply local sightseeing trips. The point is most of us are itching to get away and do something interesting.

This raises the question of will your retirement home facilitate or hinder your travel? If you’re away for an extended period, from an insurance perspective, you’ll need someone to check on things every few days.

Access to the airport may also be a consideration if you expect to fly more. When you’re close by, a taxi or Uber isn’t a big deal.

If you need to drive and pay for parking, that can add up. A related factor could be a major airport with direct flights as opposed a regional one where everything is a connecting flight.

Our Challenge

Travel is definitely high on our list as we’re contemplating wintering in warmer places. This will require our residence to be somewhat maintenance free while we’re gone. One option we’ve discussed is a condo.

Access to the airport is another consideration. If we’re going to be gone for 4-6 months, it’d be foolish to pay for parking.

11. Testing and Making a Trial Run

One of the greatest mistakes retirees make is making an irreversible (or costly) decision without fully understanding what they want and need.

One story that comes to mind is the couple who purchased a home in a tiny southern community. After months of renovations, they achieved their dream retirement home. Soon, they were bored with hardly anything to do.

They were used to dining out and attending theater performances. The locals never really accepted them and they felt like outsiders. Within a year, they were desperately trying to sell and move back.

In hindsight, they should’ve spent more time before buying anything. Perhaps staying in an Airbnb or renting a place. Even after a few months, they likely would’ve realized this wasn’t for them.

Our Challenge

We’re going to take our own advice to try out any place before buying anything. This is to ensure we’re comfortable and our needs are met.

Best Places to Retire

On the internet, there’s a vast array of information on the “best places to retire”. Interestingly, everyone has a different perspective and there’s no consensus on a best location.

This is because there are many factors involved on how to rank each place. From my perspective, some of the factors should include:

Obviously, there’s lots of other criteria which will influence your thoughts. Just because it’s affordable or has a low crime rate doesn’t necessarily mean it’s your best choice.

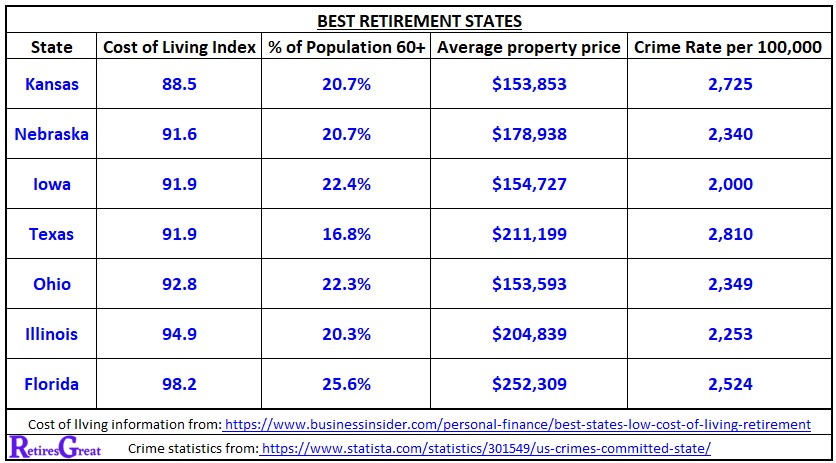

Using information from Business Insider, we’ve chosen what we believe to be seven of the best states for retirement.

As an aside, Florida is often deemed to be a retirement paradise. In fact, it has the highest percentage of retirees. It’s also expensive and the summers are dreadfully hot and muggy. Then throw in hurricane season just to liven things up.

Closing Thoughts on Retirement Location Criteria

Where to live in retirement might be one of the most important decisions you’ll ever need to make. Not something to rush through or assume all will be good.

As we work through these criteria, it becomes clear there are many factors to consider. With almost everything becoming a trade off. The key is understanding what’s most important to you versus the nice to haves.

And if your partner isn’t onboard, what will things look like? After all, it’s their retirement as well. Even retiring in place can be fraught with missed opportunities. While it might seem a safe and comfortable choice, is that where you’ll be happiest?

Another critical aspect is understanding your needs will change over time. What seems ideal today may completely miss the mark ten years from now. In this respect, flexibility is required to adapt to changing needs.