Conventional wisdom has always been that fixed interest low risk securities, such as bonds, should make up a portion of any retirement portfolio.

Most financial experts tout them as safer and a vital part of any investment strategy. Yet, with the lowest interest rates in history, does this still make sense?

The risks of investing in bonds for retirement include:

For clarity, the term bond refers to a fixed interest security with a defined rate of return and a maturity date. They're considered like a loan and can be issued for anywhere from one to 30 years.

Examples include government (such as Treasury Bills), corporate, or municipal bonds. Further, many exchange traded funds (ETFs) are available to add bond exposure.

In contrast, the equity markets (stocks) are based on business success and investor confidence. When a company is perceived to do well, share price increases or vice versa.

Another major difference is when an organization runs into financial woes. In these situations, bonds receive preferential repayment.

For these reasons, fixed interest securities are generally considered lower risk and an integral part of a retirement portfolio.

Risks of Investing in Bonds

Most financial experts have recommended adding fixed interest securities to your investments. They're deemed to reduce risk and balance a portfolio.

With the global pandemic, we're witnessing a faltering economy and many industry sectors in dire straits. Interest rates have plummeted to near zero.

These tumultuous times change everything introducing heightened risks.

Interest Rate

Back in the early 1980s, interest rates peaked at over 16%. Investing in fixed interest securities was a no brainer.

When interest rates are falling, bonds make the most sense. In effect you “lock in” with a guaranteed return.

Back in my university days, my finance professors extolled their virtues of how they were the “safest” investment at the time. Hard to argue with a 16% return from the government.

Those days are long gone and a 10-year Treasury Bond is down to 0.87%! As an investor, the S&P 500 has averaged 10% over the decades.

Obviously, interest rates can’t fall any further and when the economy recovers, they'll rise. Holding current 10-year Treasury securities wouldn’t be desirable when this occurs.

Inflation Rate

Inflation was 1.4% over the past 12 months and, typically, has averaged slightly over 3% for the past hundred years. This becomes a major concern considering the current yields of fixed interest securities.

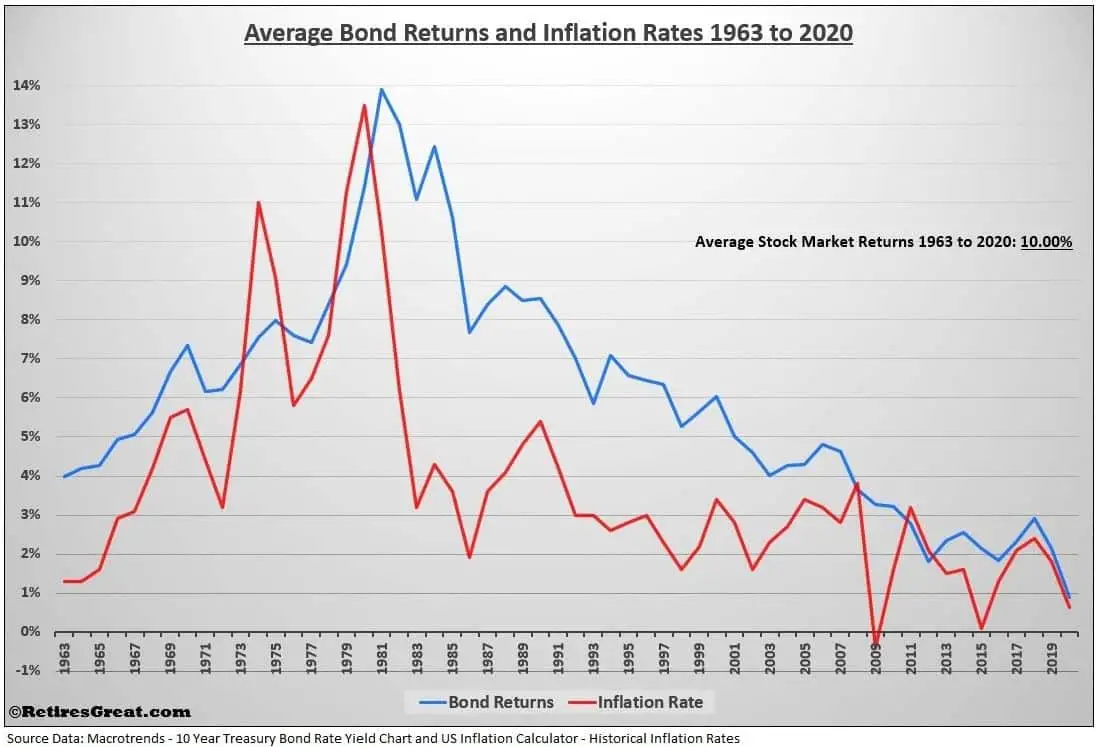

On average, bonds have beaten inflation by 2.31% over the past 57 years. The best years were back in the 80s and, since, have steadily declined.

With falling interest rates, there’s been a downward trend to the point where they’re barely ahead of inflation.

This doesn't bode well for the future of bonds when you’re barely keeping ahead of inflation.

Default Risk

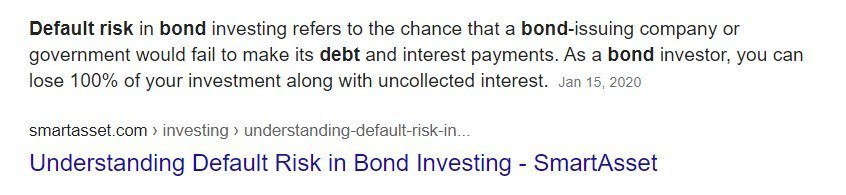

Default risk occurs when the issuer in unable to repay the contractual terms. While federal governments are considered low risk, previously high rated organizations may not be able to meet their commitments.

Some of the hardest hit industries include travel, hospitality, and retail. This might apply to certain states and municipalities equally financially stretched.

If these organizations went into receivership or bankruptcy, bond holders would be at risk of losing some or even all of their investment.

Lost Opportunity for Better Returns

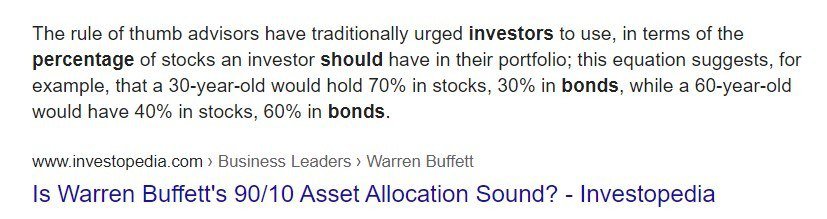

Another one of the risks of investing in bonds is the lost opportunity for better returns. Traditionally, financial advisors recommended no more than 50-75% of our retirement portfolio be invested in equities.

The underlying belief is we need to remain conservative. This comes from the rule of thumb of subtracting your age from 100 to determine the percentage of stocks.

Thus, by age 60, you should only have 40% of your investments in the equity market.

In our current economic environment, this advice could erode your financial well-being. Unless you've saved a lot, there’s a real risk you’ll outlive your savings.

Why Bonds Will Sink Your Retirement Portfolio

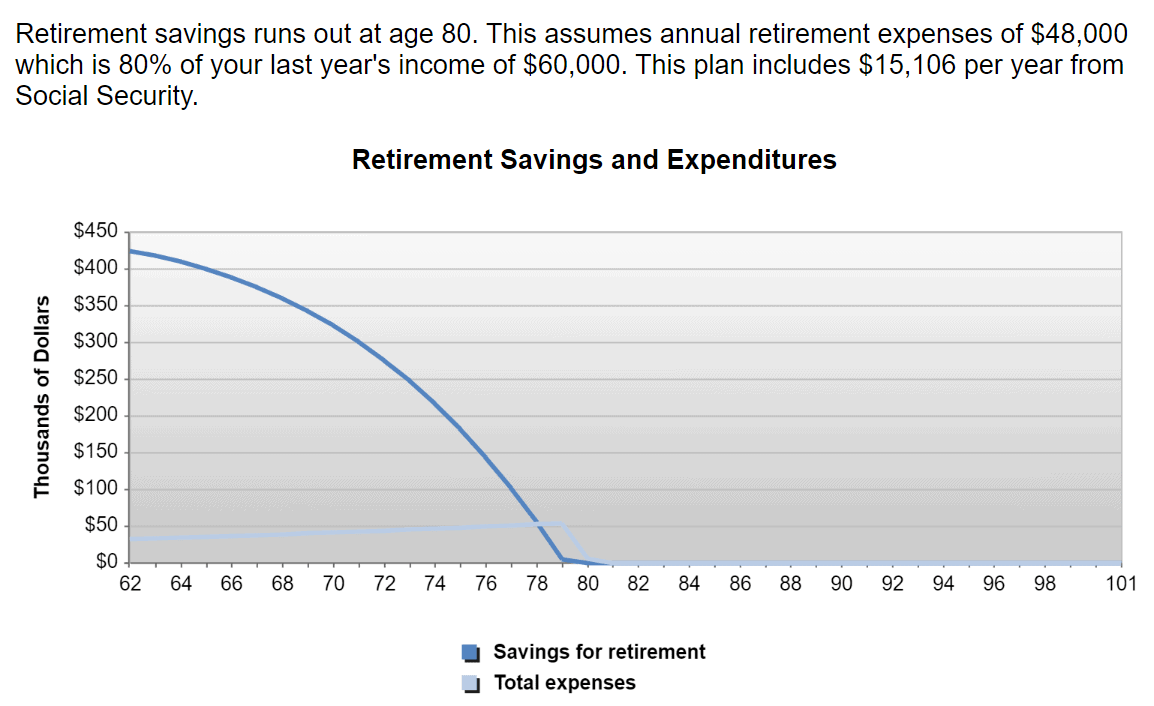

For the purpose of illustrating the impact bonds have, I’ve created three scenarios.

Our would-be retiree has saved $430,000 and wants to retire at age 62. With their Social Security, they desire an annual income of $48,000. To keep pace with inflation, they’d want a 3% cost of living increase.

Historically, equity investing has an average rate of return of 10%. Whereas bonds have been in decline, we’ll be optimistic they’ll yield a return of 4% in the future. The following graphs were created using Bankrate’s Calculator.

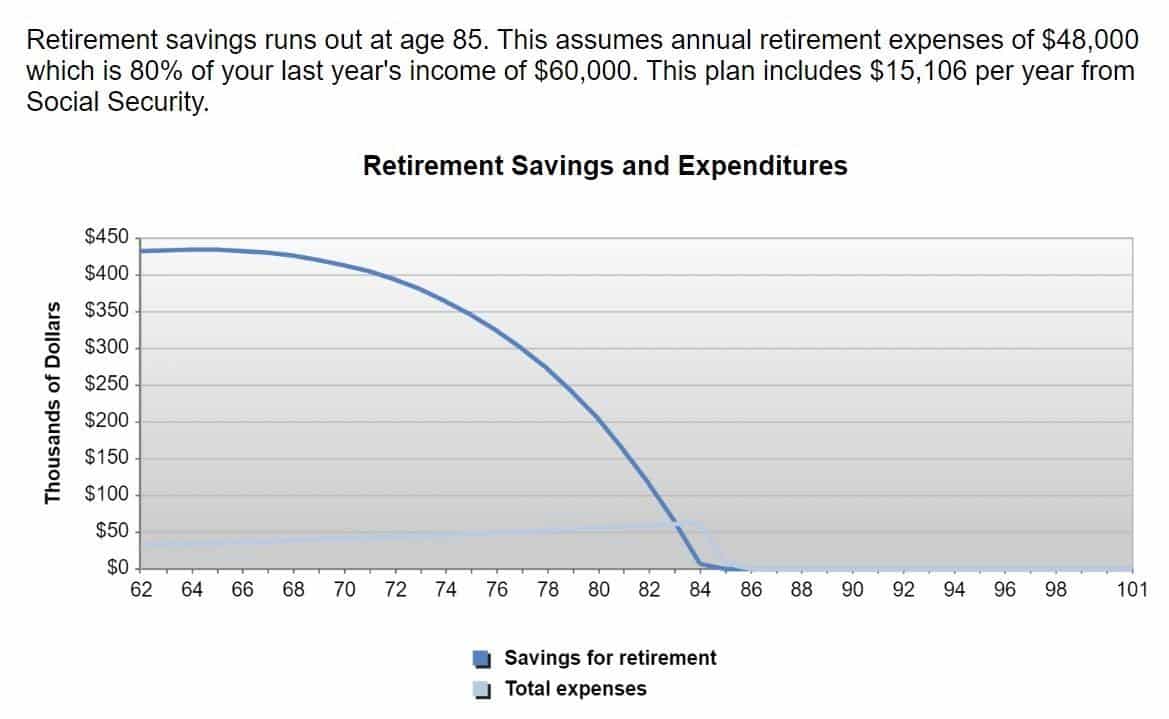

Scenario One: Investment mix 40% stocks and 60% bonds

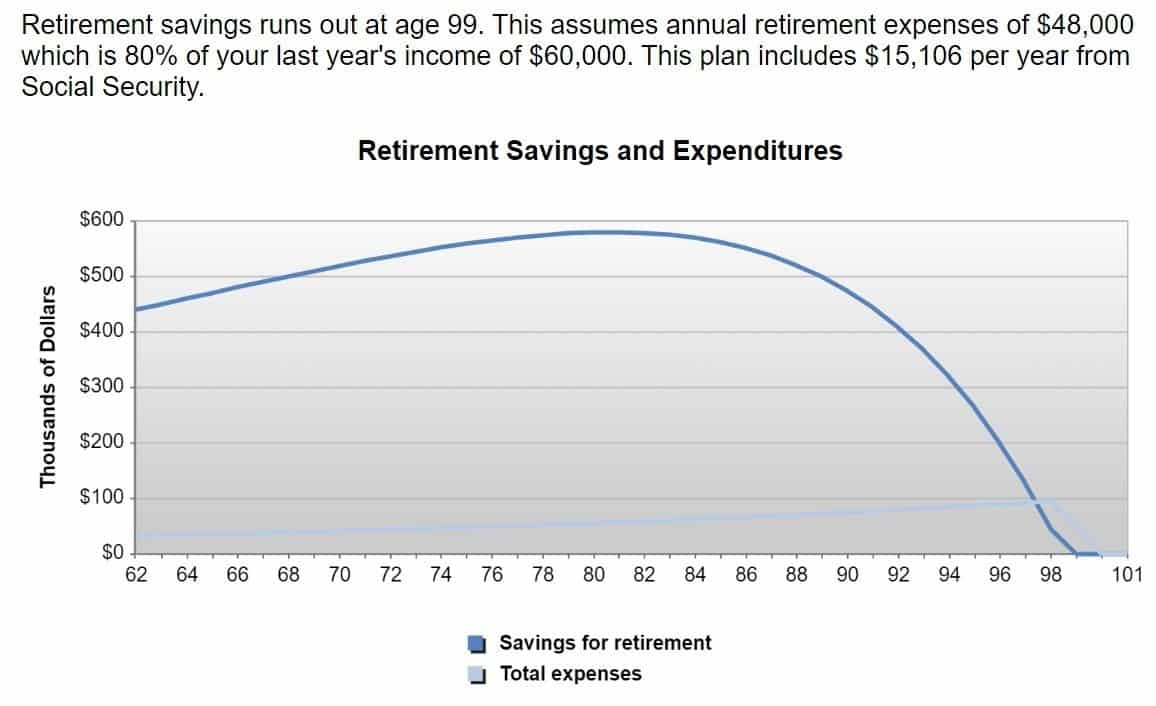

Scenario Two: Investment mix 70% stocks and 30% bonds

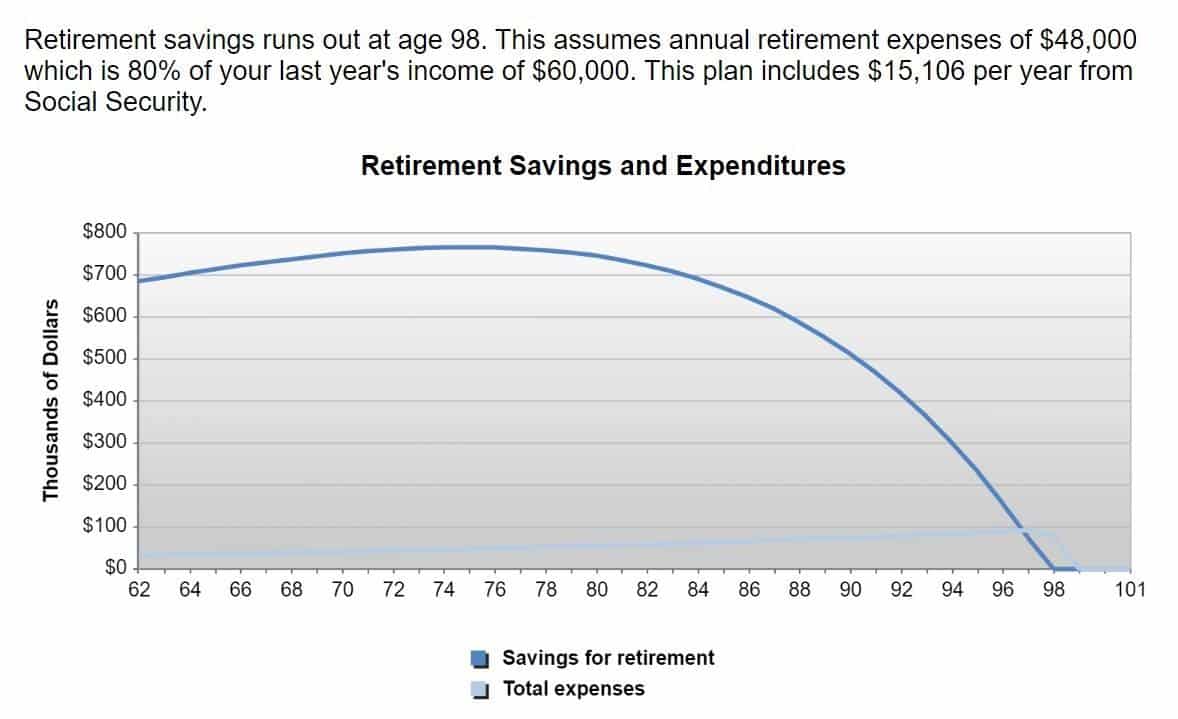

Scenario Three: Investment mix 100% stocks

As the above charts reveal, with a 40/60 split, our retiree will run out of money at age 80. The 70/30 split prolongs their income to age 85. When they’re fully invested in equities, their money lasts to age 99.

Overestimating What You Need to Save

The above scenarios underscore the impact of low risk securities and how much you’ll need to save.

The chart below reveals you’d need to save about $675,000 (as opposed to $430,000) if believed that 60% of your investments should be in low risk securities.

For some folks, this could mean continuing to work and miss out on some of the best years of retirement. Alternatively, if they're forced to retire before they're ready, they would run out of money.

Outliving Your Savings

Probably, the greatest of the risks of investing in bonds is outliving your savings. It can plague even those with extensive savings.

With medical costs skyrocketing and housing prices going through the roof, it seems everything costs more. This raises the fear of the unknown and questioning if we've really saved enough.

It can be especially true for those folks behind on their savings. Not only must they reign in their expenses, they can’t afford to take any chances.

Ironically, they’re usually the most risk adverse and gravitate to fixed interest securities. The saddest part, it’s preventable! Educate yourself, save, and invest wisely.

Are Stocks Riskier Than Bonds?

Stocks are more volatile which can produce greater returns or losses. An investment strategy diversified across numerous companies can minimize this risk.

In addition, over time the equity markets have always recovered. For instance, the S&P 500 index has an average return of 10% over the past century.

When Should Bonds Be in Your Retirement Portfolio?

There are two reasons why you might desire them: market volatility and risk tolerance.

Market Volatility

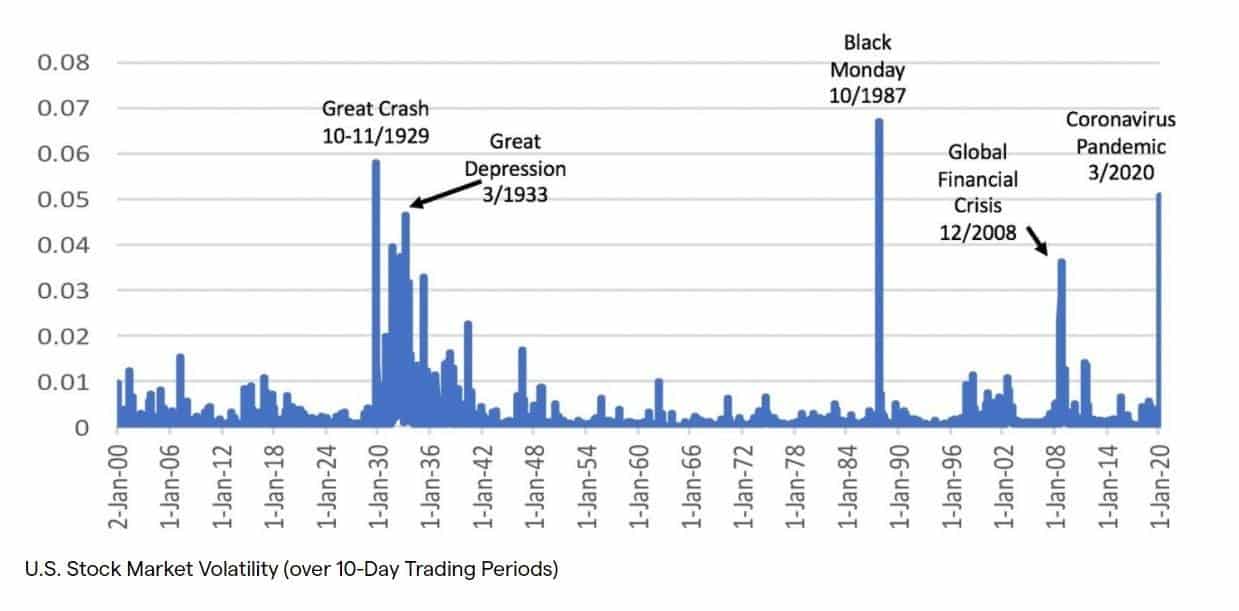

We witnessed a 30% decrease in the spring and then the market rallied back.

With subsequent “COVID” waves expected in the fall / winter, Wall Street could easily go into another tailspin. Savvy investors recognize we'll go through corrections and then recover.

As the above graph exhibits, the initial days of the pandemic created a greater impact than either the Global Financial Crisis or the Great Depression. While the stock market has rebounded, we'll likely see further corrections.

Bonds provide stability and reduce losses when the stock market declines. Of greater concern, many sectors will be slow to recover.

This is an opportunity to review where you’re invested and focus on growth sectors. Companies with a strong online presence will likely recover more quickly.

Risk Tolerance

Closely tied to market volatility is your personal risk tolerance. We’re all happy when everything is increasing in value; some people panic during a decline.

After COVID-19 hit, the fair-weather investors bailed with losses. Rather than staying the course and eventual recovery, they couldn’t stand the stress.

To share a related story, my first roommate was a fun carefree guy.

Two young bucks on the prowl, we shared many adventures and good times. One evening we were yakking and he mentioned he had $10,000 in a savings account.

I couldn’t help myself. I’d just started investing and was excited about mutual funds. Oh, how I wish I’d kept my mouth shut! I kid you not, he watched them like a hawk! Every day.

For the first few months, everything was good and he was ecstatic about his new-found growing wealth. Then the funds stalled and he was probably down a hundred bucks.

His misery was palpable and every little thing irritated him. He couldn’t sleep and dragged himself out of bed red eyed and tired.

I started avoiding him. After about six months, I was ready to kill him! Then, one evening he drove home in his brand-new car, a 1986 Mazda RX-7.

Once again, carefree and happy. Believe me, I’d learned my lesson. This time I kept my big mouth shut. Even though that was probably the stupidest thing he could've done.

There’s no question some people are more risk adverse. In hindsight, my roommate would have been better off buying Treasury Bills.

Closing Thoughts

Inherently, all investments have risk and bonds are no different. These include:

It’s your money and worth your time to ensure it’s invested wisely. You worked hard for it and you don’t want it leaving you too soon.

If you’re working with a financial planner, you'll want to be informed so the best decisions are being made for you and your portfolio.

Take the time to research and educate yourself. Make sure you and your retirement are secure and enjoyable.

right now we’re sitting on zero% bond allocation in our portfolio. heck, i couldn’t even stand our big cash pile yielding only 0.6% so i moved most of it to stocks and preferred share etf’s. of course i might end up regretting that one.

it’s a funny thing about putting fixed income into preferred shares with their 6+% yield. they carry a lot of price risk and when the whole market tanked in the covid crash our preferred stocks went right with it unlike bond funds which i think went up in value and allowed to rebalance with stocks and make some money on the recovery. it’s hard to find much that’s risk-free so we just try to make more on our stock investments for a much larger cushion….hopefully.

Very insightful, Freddy. I like your strategy of investing. And you are correct, nothing is risk free especially right now in the world.

Congrats on beating the market!!