What is the future of retirement and what will it look like over the next decade? Especially when you consider the recent pandemic and how it is changing each of our lives in so many unimaginable ways.

No one knows exactly what tomorrow will bring, thus the following are my thoughts and opinions of what may evolve in the wake of this devastating situation.

The COVID-19 pandemic has rocked our world changing our lives and the future of retirement. With the enormous amount of financial loss and global upheaval, some of the changes include:

What Exactly Happened?

First, and foremost, we are in the midst of a worldwide pandemic! There have been over 300,000 deaths and the numbers are still growing.

The global economy is at a standstill with almost every country closing its borders. We have not seen such a health crisis since the Spanish Flu of 1918.

Health Consequences

While there are positive signs the “curve is flattening”, healthcare professionals fear new outbreaks at any time. Especially as we attempt to restart the economy and social distancing practices are relaxed.

We all hope an effective vaccine will be developed soon!

The World Health Organization cautions the development of a vaccine may take years, if ever! Further, they mention this may become an endemic, much like the “flu season”.

This implies new strains of virus each season could become our “new normal”.

U.S. Economic Fall Out

The economy was at an all time high with the lowest unemployment rates seen in over 50 years. Seemingly, almost overnight, everything came to a jarring halt.

The stock markets became volatile with an average cumulative decline approaching 30%. In mid-March, the Federal Reserve lowered interest rates to 0% hoping to stimulate the economy.

That was just prior to when “shelter in place” became the social norm.

In less than six weeks, unemployment soared to levels not seen since the Great Depression. By the end of April, it was at 14.7% with speculation it could exceed 25% later in the summer.

The average American found themselves struggling to pay their bills and put food on the table.

Small businesses are decimated with many concerned if they’ll ever be able to reopen. Even large companies are hard hit laying off vast numbers of employees.

The travel and hospitality related sectors may take years to recover.

The 2 trillion-dollar stimulus package passed by U.S. Congress back in March, attempted to salvage the economy and minimize widespread suffering.

With all these stark facts and figures, what is the future of retirement?

What Will Retiring be Like in 2030?

The new normal will likely be dramatically different than that of our pre-pandemic lives. Besides responding to a COVID-19 world, we’ll need to find ways to adapt to the uncertain and shifting times.

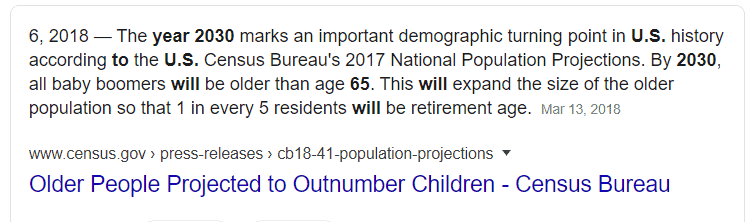

For the first time in history, in 2034, those over the age of 65 will outnumber children/youth under the age of 18. Demographically, we’ve officially become an older population.

The baby boomer generation survived a changing world including the Vietnam war, landing a man on the moon, and Woodstock.

Now we can include a once in a hundred-year pandemic! Other examples of what define us include:

Delaying or Semi-Retiring

Can you afford to retire?

That is one of the biggest determining factors for the majority of the population. Whether they have saved enough, how their investments have done, their debt level, and eligibility for Medicare and social security.

Another factor is some folks are fulfilled with their careers. They enjoy their work and have no desire to retire, at least anytime soon.

Insufficient Savings

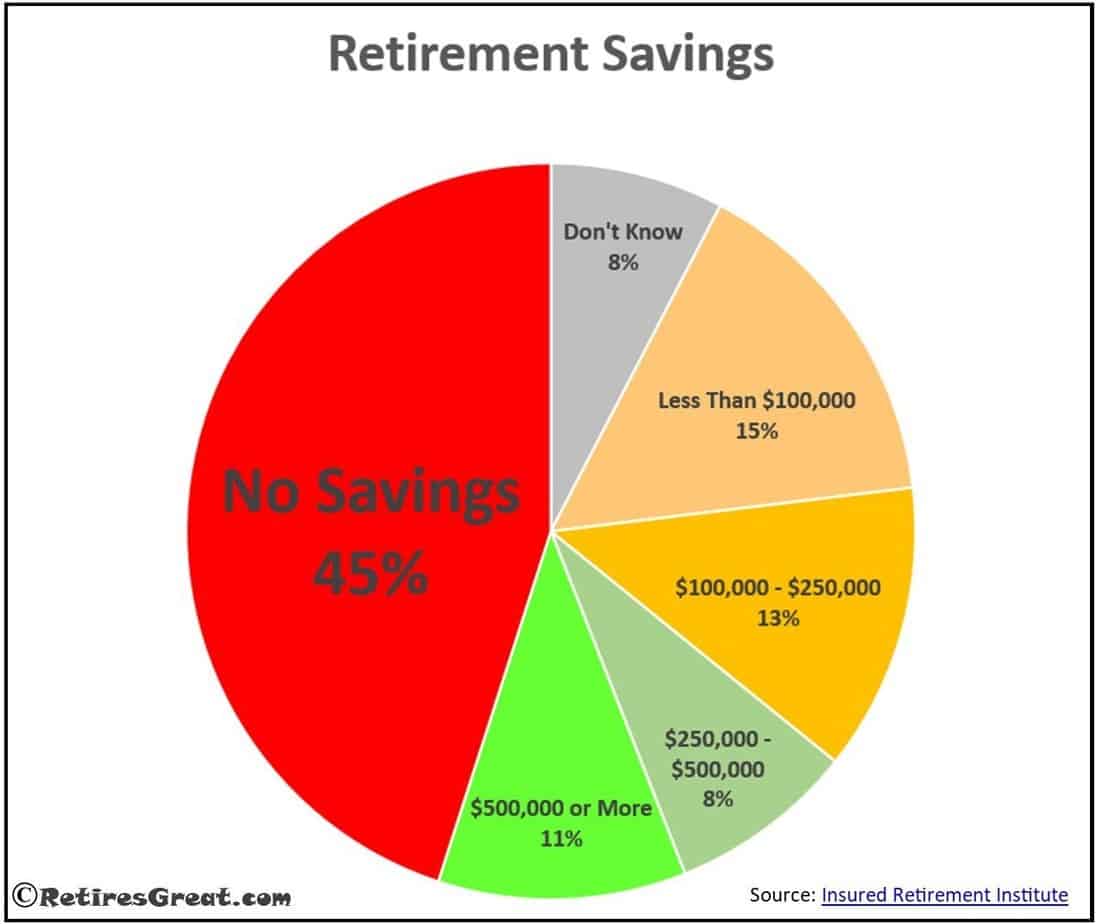

The pandemic exacerbates a growing problem, the lack of savings. In fact, 45% of Americans have no savings, at all! A further 28% have less than $250,000.

With the massive layoffs in recent months and possible permanent job loss, this situation will become even more dire.

Even those who have saved over the years are observing diminished portfolios due to the market decline.

The natural reaction for those in this position will be to keep working and save more. Dealing with job loss will become an issue for many.

Not only is it more difficult once we’re 50+, the economic environment may be challenging for some time.

Unfortunately, corporate downsizing and ageism is far too common. Statistically, as many as 56% of older employees have been forced to retire.

The job-hunting process become more difficult and frustrating once we are in our mid-fifties. In fact, only about one in ten will find another job with a comparable salary.

The net effect is we observe growing numbers of people with woefully insufficient savings to be able to afford retiring.

My thought is the average age to retire will be increased. In addition, semi-retiring with a part-time job may become more prevalent. The future of retirement has changed forever.

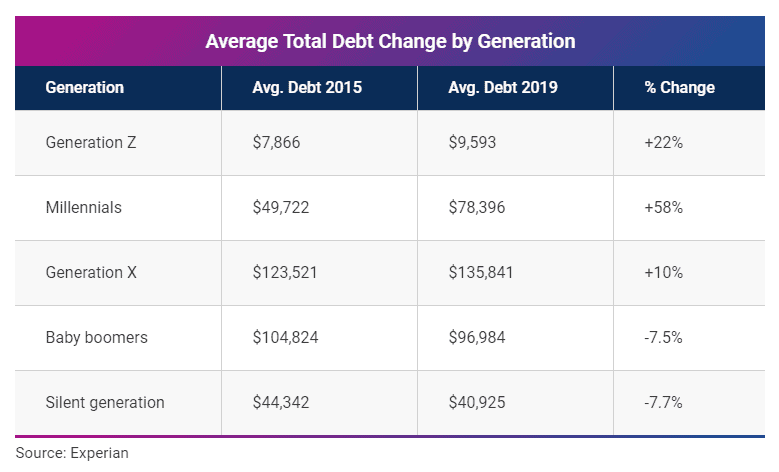

Increased Debt

For the past dozen or so years, the interest rates have been at historical lows. In mid-March, the Federal Reserve cut its benchmark interest rate to 0% to stimulate the economy.

While that’s great for borrowers, it also means incurring more debt.

According to Experian, the average debt for baby boomers in 2019 was $96,984, a slight decrease from 2015.

The massive layoffs due to the pandemic has created financial disasters for many households. Any emergency and savings funds are needed to meet monthly expenses and may be depleted.

Additionally, major debt is being incurred at unprecedented rates.

This has a further impact as paying off debt is not conducive to investing for the future of retirement.

Fulfilling Careers

If you enjoy what you do, why would you retire?

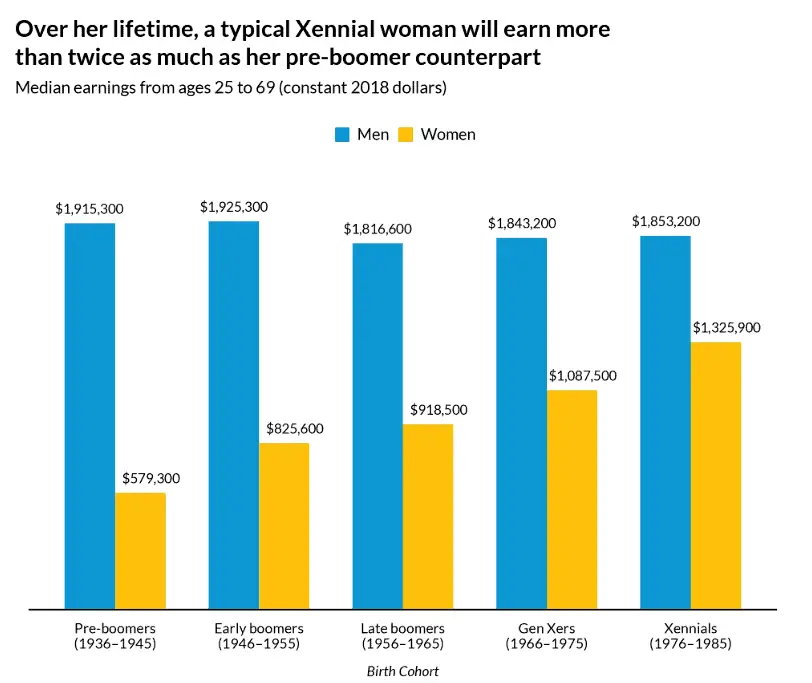

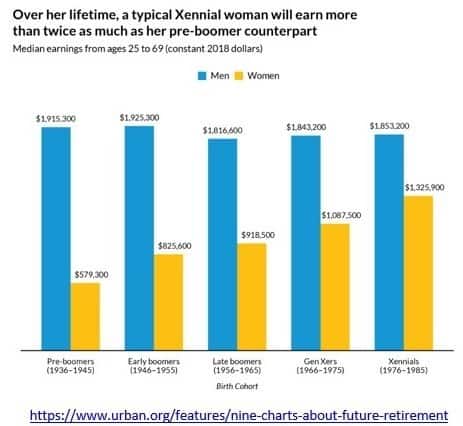

This is exactly the dilemma a growing number of women, especially, find themselves in. Traditionally, women have been caregivers sacrificing their careers to remain home raising children.

Gender inequality persists to this day with men typically earning 40% more for the same work. Although, this is slowly changing with better opportunities for advancement and higher compensation.

After re-entering the labor market, the careers for some women steadily rise attaining positions of greater autonomy and responsibility.

Whereas their husbands may be thinking of retiring, they are now at the top of their game. Often, it's not even about the income; these women feel empowered and that they are making a difference.

Healthcare Reform

You likely saw the news how the healthcare system was stretched nearly to the breaking point. Front-line workers worked tirelessly to stave off unimaginable death and misery.

The lack of personal protective equipment and resulting infections compromised their ability to keep up. If we have a Round Two in the fall, things need to change!

In fact, there needs to be significant healthcare reforms. Americans pay more per capita (almost double) than any other country in the world. Yet, rank 27th in the world.

Healthcare shortcomings include:

The COVID-19 response exposed many weaknesses and an overall lack of preparation. While the government bore the brunt of the costs, at some point these costs need to be recouped.

This might be through higher taxes or, perhaps, increased healthcare costs.

Expect Higher Taxes

The final price tag for COVID-19 will be staggering!

The human cost is incalculable in lives lost, mental health, and job loss. From a financial perspective, the economy is in a major recession that may take time to recover from.

Healthcare costs, stimulus payments, business loans, and unemployment will total in the trillions of dollars. The government will need to find ways to address these deficits.

The federal income tax introduced in 1913 was intended to finance the costs of the first world war. It never went away; over the years the taxes continue to increase.

The government has limited options replenishing costs associated with COVID-19. They need to get the money from somewhere and that usually means higher taxes.

Ultimately, each of us will be paying in some form for the economic losses.

Will Social Security Be Enough to Retire On?

Social security was never intended to be the sole source of income after retiring. Rather it’s a supplement to be combined with savings and/or a pension.

Of even greater concern, social security trust funds are expected to run out by 2035! Currently, payments exceed payroll tax revenues.

The Social Security Administration will be faced with increasing payroll taxes, raising the age of eligibility or reducing benefits (~75% of current) to achieve sustainability.

My belief is benefits will either be reduced or the age of eligibility increased. By 2035, about half of all retirees could find themselves still working or surviving on a greatly reduced income.

Travel Challenges

Travel is something most retirees plan on doing more. During their working years, they were constrained by the amount of time off they could take and other obligations such as family.

The travel and hospitality industries have been absolutely demolished. As we’re all aware, borders are closed and travel for leisure purposes has ground to a complete stand still.

Staff have been laid off, yet the massive investments in infrastructure incur ongoing interest and upkeep costs. Examples include:

After the pandemic moderates and it becomes safer to travel, we’ll likely see “deals” to incent us to take a vacation.

However, over the longer term the cost of travel will likely be significantly more expensive and hidden costs added in.

Remaining Tech Savvy in an Online World

It might be necessary to get a part-time job to help make ends meet. If possible, something that could get your foot in the door toward a full-time position that you would enjoy.

Even with cutting back and part-time income, it may not be enough. Other options to help tide you over until finding new employment can include:

The reason I mention these things is that they will take on greater importance. We’ll all need to embrace technology to keep current with the online world.

With respect to healthcare, in addition to telehealth, we’ll see new ways of better managing our medical information.

In South Korea and other Asian countries, “apps” have been developed for pandemic monitoring and tracing purposes. These may become standard practice to ensure safety and better minimize subsequent outbreaks.

Closing Thoughts on The Future of Retirement

What lies ahead tomorrow will be vastly different than any of us may have imagined or expected. Those fateful first months of 2020 triggered a series of events that have forever changed our way of life and attitude.

Hopefully, our new normal might return to something resembling pre-pandemic times (with an effective vaccine of course). Yet, in many respects the damage is done and each of us will need to find ways of adapting and living in our changed world.