Never before in our lifetime have we been faced with, both, a global pandemic and recession.

Seemingly overnight, the world drastically changed. It’s only natural to have concerns for any future security during these uncertain times.

Vaccines offer hope our lives will soon return to some semblance of normalcy. Until that time, we’re stuck in this topsy-turvy world.

Three things to consider for your financial future include:

Before jumping into it all, let’s understand the significance of the pandemic in light of all the economic turmoil.

Pandemic Pandemonium

Back in early 2020, everything looked rosy with the U.S economy enjoying almost unprecedented success, such as:

Then the wheels fell off the bus!!

In a matter of weeks, the onslaught of the pandemic was upon us. Hospitals were overwhelmed and we went into lockdowns. Unemployment soared to 14.7% with the markets losing as much as 30%.

The Post COVID World

The Great Recession pales in significance to the economic and human cost of the COVID-19 pandemic.

A recent study published in the Journal of the American Medical Association predicts the pandemic could end up costing the U.S. $16 trillion!

According to public health experts, with a vaccine, we may have some normality by mid-2021. Healthcare costs are staggering and long-term health implications are still to be determined.

To their credit, federal and state governments have done what they can incurring almost unimaginable debt. The emergency relief Stimulus Package cost over $2 trillion. Never before have interest rates dropped to zero.

Entire industries, such as airlines and hospitality, are decimated. Economists estimate as many as half of all small businesses will no longer exist.

Survival will require organizations to adapt. We’ve already observed widespread layoffs and furloughs.

Work from home is here to stay. We’ll likely see more downsizing and early retirement incentives to further reduce operating costs.

The business landscape will be vastly different in our “brave new world”. Isn’t that a positive message to kick off a discussion on the three things to consider for your financial future?

Financial Plan

Without a plan, how do you know if you’re heading in the right direction and on track?

Only about 1 in 3 Americans have a plan for their finances. The rest do their best to make ends meet and pay their bills on time.

This is akin to treading water and hoping the tide will wash them ashore. Those with a plan are purposefully swimming, by saving and investing.

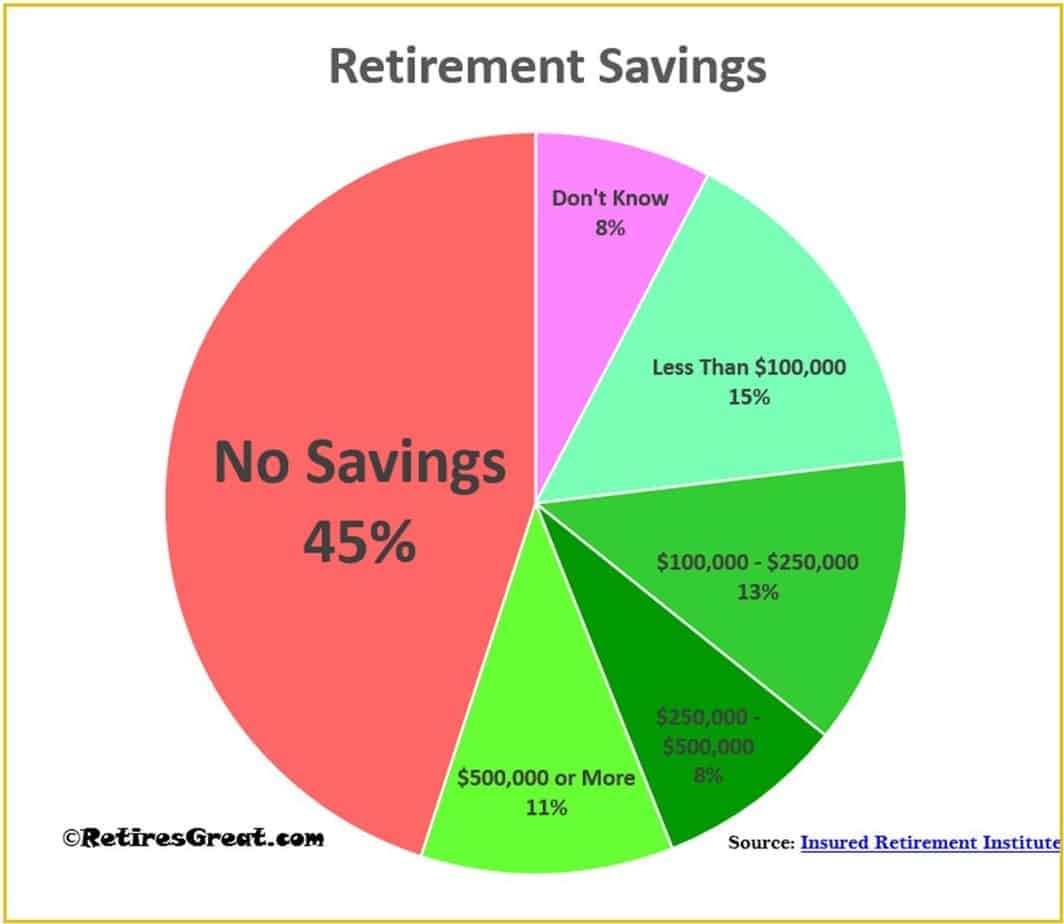

By the time the average person is ready to retire, about 3/4 of us have none or insufficient savings! Baby Boomer Facts uncovers the numerous factors behind this alarming statistic.

There’s lots of folks behind on their saving. If you’re one of them, it’s time to make a plan.

What the Plan Should Cover

A personal plan for finances should capture all expenses. If you already have trouble keeping up, there may be areas that need to be cutback.

Remember, the goal is preparing for tomorrow and beyond.

Savings

While you’re still working, “pay yourself first” is an important principle. Every paycheck, set something aside. One of the easiest ways is through payroll deduction.

This works particularly well when the company offers a matching contribution. This is like free money. Surprisingly, about one in five workers don’t contribute enough to take full advantage of this.

Investing

Stay educated on, at least, the basics of investing and take an active role in monitoring all investments. If this isn’t a strong suit for you, then seek advice and support from an expert on finances.

After retiring, you’ll want a withdrawal strategy aimed at minimizing taxes and preserving income.

Expenses After Retiring

Everyone assumes their expenses will be less in retirement. This isn’t always the case and might remain the same or even go up.

Desired lifestyle and health costs can become significant factors. Creating a Financial Plan for Retirement provides more information and a sample worksheet.

Emergency Fund

About half of Americans don’t have an emergency fund and live paycheck to paycheck.

By no means is this unique to those with lower incomes scraping to get by. Many affluent people get caught on the “treadmill of consumerism”.

The more they make, the more they spend. The list is endless, a bigger house, newer car, vacations, etc. When they least expect, an unplanned event can rock their world.

An emergency fund is like a personal safety net. Sooner or later, we’re going to incur something such as:

You really can’t really plan for most of this stuff. And, all too often bad luck seems to come in 3's. The real value of an emergency fund is to provide a cushion for these setbacks.

Managing Your Emergency Fund

How much should you keep in an emergency fund?

In light of recent events, a year’s worth of expenses would be preferable. This money should be easily accessible such as in a savings account. In spite of low returns, it's available when you need it.

Alternatively, a home equity line of credit (HELCO) may be another option. In contrast, investments aren’t as liquid. If the market drops, you’d take losses.

In addition, withdrawing from a 401K would incur possible taxes and early withdrawal penalties.

Reduce Debt

The last of the three things to consider for your financial future is reducing debt. Debt isn’t your friend!

Yet, everyone's become accustomed to it. My parents took out a mortgage on their home; their only debt.

The only credit card I recall my father having was for Texaco. Actually, that was my first card as well. They even paid for their vehicles with cash.

Times have changed. How many credit cards do you have? They’ve become the basis for our daily transactions. Hardly anyone carries cash anymore.

Understandably, paying with cash is discouraged during these troubled times. Without one, forget about making an online purchase.

The downside is it's easier to overspend. The companies prefer you not pay the full balance and always offer a minimum payment.

Awful decent of them until their insane interest rate (20% plus) kicks in. That’s when lots of folks start getting in trouble.

Seems everyone wants to extend credit whether at the bank or a local auto dealership. If you’re not careful, it’s like sinking in quicksand.

“Debt is like quicksand. The deeper you sink, the more difficult it is to get out."

Retires Great

According to CNBC, the average debt for baby boomers is $96,984. What a way to kickoff the golden years, huh!

Managing Debt

Significant debt is going to eat into any savings you have affecting the quality of life after retiring. The millstone weighing you down that’s not going away, unless you do something about it. Some options include:

According to Moneytalksnews, researchers from four U.S. universities found one in seven bankruptcies were by those age 65 or older.

This represents nearly a five-fold increase over the past 25 years. Either, you manage your money or it will manage you.

Closing Thoughts on Three Things to Consider for Your Financial Future

This double whammy of COVID and economic slowdown creates fear and uncertainty. Your future will be safer and more secure by taking these points into consideration:

While you might think these are basic concepts and common sense, far too many people fail to do them. To keep your finances in line, keep it simple. There’s no need to reinvent the wheel.

If there is a silver lining to this pandemic, it taught us to prepare for the unexpected. By doing so, you’ll be ahead of the game with greater peace of mind.