Who hasn’t been a victim of some sort of fraud? I thought I was pretty sharp when it came to security, only to learn how much I didn’t know!

It's like waltzing through a minefield completely unaware of the risks. Only by educating yourself and keeping vigilant, is there a chance to remain unscathed.

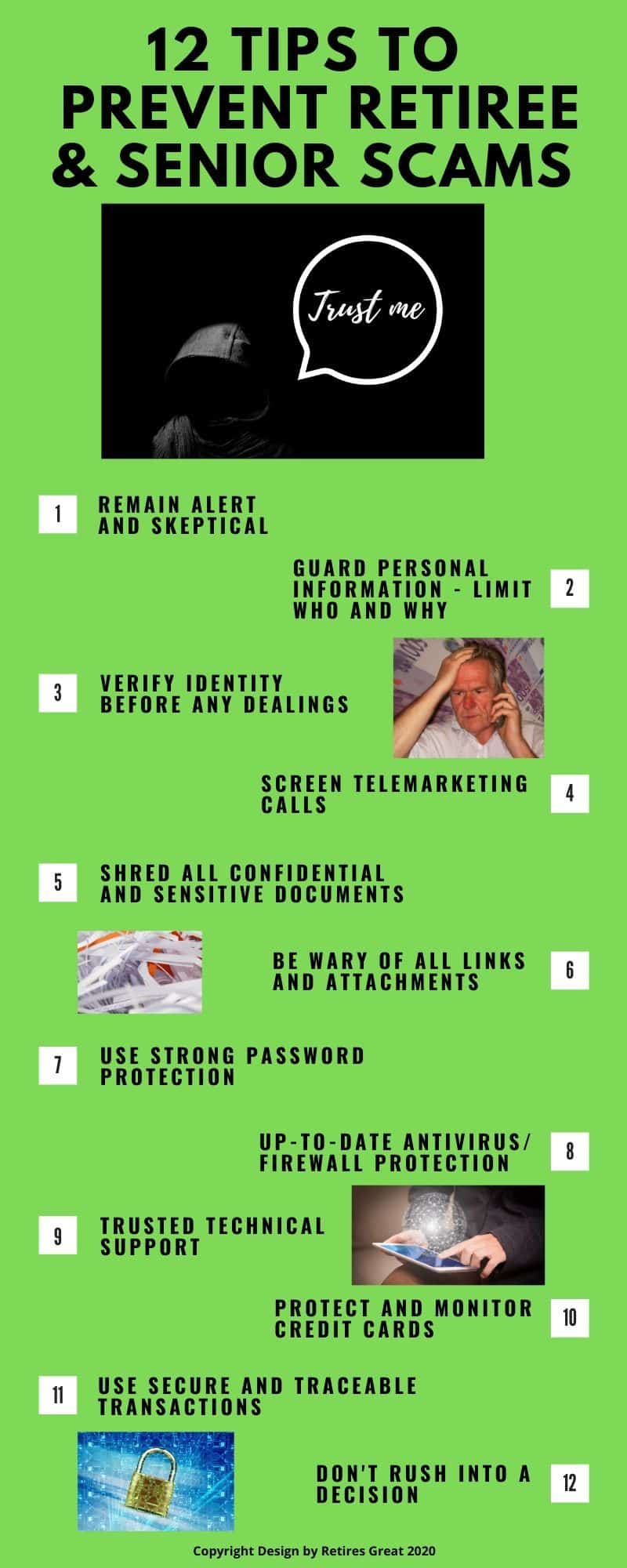

12 Tips to prevent retiree and senior scams include:

Identity Theft and Fraud Activity

Frustrating how bad it has gotten with someone at every turn trying to take advantage of us. Last weekend, I got scammed! I’ll save that story for the end as it’s particularly embarrassing for me and I should have known better.

The scary part is scammers have become far more sophisticated than most of us are aware. In fact, it’s often difficult to determine what’s real or not.

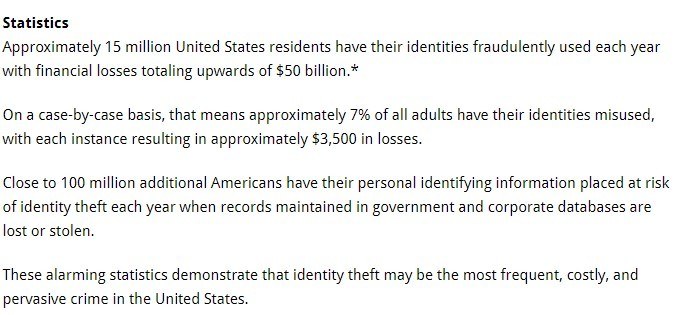

They’ve become so good at it that 14.4 million people became victims last year losing $1.9 Billion. And that’s only the tip of the iceberg as most of the time it goes unreported.

While we should all know better, it's embarrassing to get suckered. Unless it involves a lot of money, most of us don’t bother reporting it. And it's not like anyone ever seems to get caught.

For most of us, we change our passwords, update security, and whatever else needs to be done. It sucks and we prefer to lick our wounds while suffering in silence.

In effect, we’ve become “hardened” to this pandemic of illegal activity. We hardly bat an eye after hearing the latest data breach of some large company. Unless of course they have our credit card data and we become at risk.

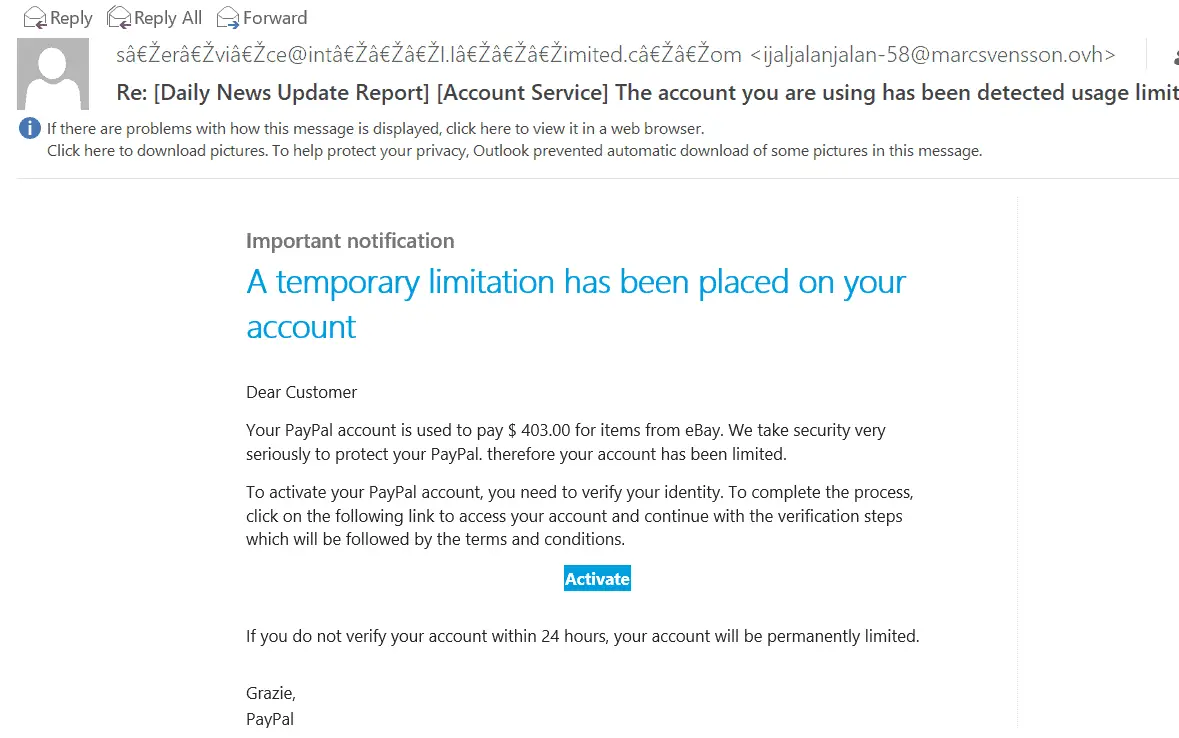

As I compose these thoughts, my email chimes with yet another blatant attempt of fraudulent intent.

The header of the email reveals this is a rather pathetic attempt. Obviously not from the official PayPal site.

However unsophisticated this one is, other attempts are far more convincingly. What would happen if we let our guard down and clicked on the “Activate” button?

Well, I’m not about to find out!

My speculation is they hope I have a PayPal account and are gullible enough to disclose my account information. Then they’re set for a shopping spree at my expense.

Stay Alert and Skeptical

As bad as it sounds, the average person is way too trusting. You need to remain vigilant when anyone approaches requesting personal information. The fraudsters prey upon us in every way possible.

The person approaching you in the mall or a telemarketer likely doesn’t have your best interests in mind. You may get an offer in the mail that seems too good to pass up. Social media and emails you receive are rife with temptations.

We’ve all heard of the schemes such as “You’ve won a lottery, contact us at…”. Or, they’ve found a long lost relative and you’re eligible for an inheritance.

We all know better, yet some folks still fall for it. They want to believe and they get taken advantage of. Remember, if it sounds too good to be true, it probably is!

Another tactic is fear. In the midst of this pandemic, with many financially behind, there’s another hoax circulating. “Your utilities will be cut off immediately unless…”.

That’s only the tip of the iceberg, other variations such you’ve contracted COVID-19, the IRS is investigating you, or a warrant is out for your arrest.

What Should You Do?

Remain skeptical and recognize the majority of these are fraudulent attempts. Don’t trust whomever contacted you or take things at face value.

If you’re concerned there might be substance, verify everything you can. For instance, if there’s a possible IRS violation, you should contact them on their official website or a number you know to be valid.

Guard Your Personal Information

Guard your personal data and share only with those who legitimately require it. Treat everyone on a need to know basis. Whether it’s someone at your front door, over the phone, an email, or on social media.

Restrict sharing any confidential information. Identity theft is on the rise and lucrative business for fraudsters.

According to Lifelock, “Once someone has your Social Security number, they can essentially become you.

They may be able to collect tax refunds, collect benefits and income, commit crimes, make purchases, set up phone numbers and websites, establish residences, and use health insurance—all in your name. It’s a messy business that’s challenging to clean up.”

If someone were to steal your credit card, it can be cancelled. Frustrating for sure and charges need to be disputed, but everything returns to normal eventually. Not so much with identity theft!

A thief can use your social insurance number to become you. They can access many financial and medical records further expanding their control over your life. You’re likely even aware of it happening at the time.

At least until your savings disappear and the fraudulent income tax returns. Utility and telecom accounts might be opened under your name. Then your social security number might be sold on the “dark web”.

Your Medicare number is also highly desirable. When it falls into the wrong hands, it can be used to create false billing and claims.

One of the tricks is someone approaching you with a “free” gift outside a clinic, but they’ll need your Medicare number.

Verify Identity

Understanding how valuable our personal information is begs the question how to protect it. The answer is to always verify identity and why someone needs it before sharing anything confidential.

One of the oldest tricks in the book is for someone to call on a false pretense trying to get you to divulge what you shouldn’t. Con artists are doing this with Medicare cards.

“Medicare, or someone representing Medicare, will only call and ask for personal information in these situations:

- A Medicare health or drug plan can call you if you’re already a member of the plan. The agent who helped you join can also call you.

- A customer service representative from 1-800-MEDICARE can call you if you’ve called and left a message or a representative said that someone would call you back.”

According to Medicare, all cards are being updated to remove social security numbers and minimize identity theft. They state on their site:

Another trick is bogus emails designed to appear they are from your bank or credit card company. These can be very convincing and they’ll explicitly state a problem requiring your immediate attention. The number provided will be their own.

How to Avoid

Never give out any personal information until you can verify the person is authorized and entitled to it. That means ensuring genuine numbers and websites or doing it in-person.

Screen Telemarketing Calls

For decades we’ve been cheated by telemarketers. It’s a numbers game and it works. With all the technology advancements, computers initiate thousands of calls per hour.

When someone answers or returns a call, then it’s directed to an agent trained to bamboozle you. This is big business becoming even more subtle and effective.

It used to be the promise of a lottery win or an inheritance. Now you can’t tell even tell if they’re a legitimate charity canvasing for donations.

Several months back I received a voice message from my bank. Apparently, there was something amiss that could impact my credit score.

The message suggested either stopping by my local branch or calling their customer service at 1-800-XXX-XXXX. I wasn’t crazy about standing in line at the bank, especially in the midst of a pandemic.

The message sounded credible and I sure didn’t want my credit impacted over some mix-up. That’s when I double checked the toll-free number. Hmmm… slightly different than the banks published number.

OMG, this was a scam! If I had called their number, the standard process is to confirm identity, I’m sure they would have asked all the usual questions such as address, birthdate, account number, etc.

In short, identity theft. On top of that, I’m certain, “clearing up the issue” would involve paying some fee.

How to Avoid

The most effective way to deal with telemarketers is confirming if they’re even legitimate. The best bet is calling them back at a number you know is genuine.

For myself, I seldom answer the phone unless I know who’s calling. By letting it go to voice mail, then I can decide what to do. In addition, you can limit calls by enrolling on the National Do Not Call Registry.

For more information on blocking unwanted calls, the FTC offers further options.

Shred Sensitive Documents

The number one reason for shredding your documents is to protect yourself from identity theft. 9 million Americans fall victim to it every year.

Anything that contains your name, address, phone number, email address, social security number, etc. could be used to set up new accounts under your name by the thief.

When it comes to bank statements, utility bills, old tax returns, etc. these should never be thrown in the garbage. Remember, once it is removed from your property, it is legal for anyone to take it.

The only safe way to dispose of them is to shred them. This is the best way to avoid any future problems. Even junk mail can be a source of information for fraud.

There are usually bar codes on the envelopes that could, potentially, include some personal information. This could include generic credit card offers or offers from other companies for you to sign up.

Other examples of documents you should shred and, maybe, not necessarily think about are:

The Best Way to Destroy Sensitive Documents

Shredders used to be expensive; now they’re around thirty bucks. Bag up your shredded material and take it in for recycling.

Another option is dropping your documents off at a shredding service. You should be able to find a local service nearby that’s cost-effective.

Finally, as we love sitting around a fire, we burn our sensitive documents. Makes great fire starter and works for us. This is one of our favorite tips to prevent retiree and senior scams!

Be Wary of All Links and Attachments

If you receive an unfamiliar email, text, or something on social media, be wary of clicking on any links. We’re all tempted to click on something that captures our interest, but is it safe?

By hovering your cursor over the link, you can get a better idea where it goes. If you click on it, you could make yourself vulnerable to a phishing attack.

This could mean malicious software enters your computer, tablet, or smart phone. And you’ll likely have no idea until later. Even some websites have been compromised. Without an "https:" prefix, it’s deemed as a less secure site.

As a crude analogy, unless you know for sure what you're clicking on, it's like having unprotected sex with a stranger. Let me ask you, do ya feel lucky?

Inadvertently, you might have just downloaded malware capturing your passwords or, worse yet, ransomware.

Use Strong Password Protection

My cousin’s email account was hacked recently leading to my grievous experience. In fact, over 2.5 billion user accounts have been hacked this year alone!

What would you say if I told you a five-character password, with symbols, could be hacked in 10 seconds? That is the brute force method.

According to How to Geek, the traditional advice for a strong password includes:

Also, you should have separate passwords for each application. This raises the question of how to keep track of all of them? Their suggestion is using a password manager.

I should also mention, we don’t allow our computers to auto save our passwords for important applications. If they were ever hacked, at least they wouldn’t have easy access to our banking and financial information.

Maintain Up-to-Date Antivirus and Firewall Protection

We’ve all done it. Your computer asks you to install an update while you are trying to frantically get something done. You click on “later” or “not right now” thinking you will go back to it.

However, you forget and now that, probably, vital update has been missed. This leaves you open to a breach.

New computer viruses are being identified on a daily basis. So, you have new viruses or malware (malicious software) that are floating around in the ether just waiting to get into your computer.

Keeping your antivirus and firewall up-to-date is critical to the security of your system. These add the latest files to your computer. So, it knows what to look for and protect you from the latest threats.

If a hacker were able to get into your machine, they could potentially pull out a lot of your personal information. They could use this to apply for credit cards or loans on your dime.

Data breaches happen when your computer is not current and a new piece of malware figures out how to break in. To combat this, make sure you do the updates.

You could set them to automatically update (easiest) or set a schedule for yourself to check for updates and do them at a more convenient time.

Only Use Trusted Technical Support

Sooner or later we’re all going to run into an issue we’re unable to resolve. Unless you already subscribe to a reputable tech support organization, who do you call? The internet is rife with shady operators posing as tech support.

About 3.3 million people get ripped off each year costing them $1.5 billion. That’s an average cost of $450 for the privilege of them installing malware on your device.

Think about that for a moment, you’re paying them for changes that will cripple you.

Several years ago, a close friend was a victim of one of these bogus support groups. She’d found them on the internet and was pleased with the idea of “lifetime” support for $500.00.

They appeared professional and proceeded to “upgrade” her security and take care of all her problems. After several days, her computer began to act strangely.

While I’m no expert, after she mentioned it, I realized there was something seriously amiss. Amongst many other things, they were trying to hack into her bank account.

Needless to say, her computer needed to be wiped clean and completely rebuilt.

What Should You Do?

As I mentioned earlier, it's like a minefield and sooner or later you’re going to need help. Be very wary of who you trust, especially with access to any of your electronic devices.

Subscribe to a reputable tech support service. Their cost is a pittance compared to getting ripped off. Consumer Affairs reviews some of the best tech support services.

Use their services such as a quarterly security review where they run scans and thoroughly check everything over. Get their assistance when you want to download a program or a game to ensure its virus-free.

Protect and Monitor Credit Cards

How safe are your credit card(s)?

According to Creditcardinsider, credit cards are fairly safe if you take some precautions. These include:

Credit cards are governed by federal rules and you can dispute unauthorized charges. This is not the case with debit cards. Another advantage is when you purchase something online, if it doesn’t arrive or is damaged, you have grounds to dispute it.

Even with the all the benefits, you can still run into problems.

What Else Can You Do?

For even more protection you can use a payment gateway such as PayPal or Apple Pay. Besides having another organization to help with a dispute, you also limit who has your credit card number.

After hearing of all the data breaches on the web, we’re reluctant realizing our card could be compromised by a company’s lack of security.

In addition, we sometimes use a “secondary” card with a low limit. Although we aren’t getting any “rewards” for our purchases, if need be, we have no qualms about cancelling it.

Use Only Secure and Traceable Transactions

Honest companies would never ask you for some untraceable means of payment. Most have a contract or some means of specifying their terms and conditions.

In contrast, someone attempting to take advantage of you would prefer a verbal agreement with cash up front. An example could be a contractor offering you a deal on a new roof.

First of all, do you really need one? Secondly, how are you going to resolve a substandard or incomplete job? When it comes to the online world, never send money to someone you don’t know!

The last thing a fraudster wants is a trail of accountability. They want money and then to disappear. Some of the ways include:

Don't Rush into a Decision

Who isn’t guilty of rushing into a decision we later regret? Too often we take things at face value justifying taking action without all the facts. Instead of taking the time to think it through or discuss with someone, we leap into action.

This is my story of how easily I was scammed last weekend.

I really questioned whether or not to share this tale of woe. My wife argued this would be of value to others. She also pointed out I’ve already embarrassed myself to the world, so why hold back?

That was in Dealing with the Fear of Growing Old and the “unmitigated disaster” and vanity of coloring my hair to look younger.

Last Sunday I received an email from my cousin requesting help.

Hello,

How are you doing? I need a little favor from you, Let me know if you are available.

Awaiting your response

I’ve known my cousin all my life and hold her in high esteem. Last year she bought some fertilizer from the farm store which saved me a bundle. Without a second thought I responded with, what could I do?

She replied right back.

I would've prefer to call you but can't receive or call at the moment with my line. Sorry for the inconvenience, I need to get a Google play Gift Card for my Nephew, Its his birthday but i can't do this now because I'm currently traveling. Can you get it from any store around you? I'll pay back as soon as i am back. Kindly let me know if you can handle this for me

As you can imagine, Shannon’s kicking into high gear. Like rapid-fire, thoughts shot through my mind, such as:

I swept aside all these doubts. I wanted to help out!

Did you know it’s really easy to purchase Google Play cards online? To be precise, all four $100 cards.

Like a man on a mission, within about 15 minutes I had an email composed inserting all the card codes.

Right on the verge of clicking on “send”, I felt momentary doubt.

Something just didn’t feel right. Debbie said “maybe you should call first”.

My cousin was shaken and mortified. Apparently, this was the 3rd or 4th time her email had been hacked! Would have been nice knowing that! I didn’t mention purchasing the cards as she was clearly upset and embarrassed.

She said she was going to change her password to one much tougher and install Norton antivirus. That, my friends, is how 12 Tips to Prevent Retiree and Senior Scams came to be.

Lessons Learned

Resist the impulse to act immediately. This was not a life or death situation. I wish I’d taken a little more time. Instead of questioning and checking things out, I was in a hurry to act.

Talk to someone else. My wife made an excellent suggestion to call. Why didn’t I think of that? A fresh perspective can be invaluable in avoiding being suckered.

Don’t buy Google Play cards. They won’t refund them and we’re now stuck with $400 to spend on nothing that interests us.

Closing Thoughts on 12 Tips to Prevent Retiree and Senior Scams

Wow! This turned out to be a bigger project than I thought it was going to be. This article is about as comprehensive as it can get.

There are a lot of people out there who make a living at identity theft. They continue to hone and refine their skills. Wouldn't it be nice if they got a real job? The world would be a safer place.

Looking into all the ways to keep yourself safe proved to me that I still have a lot to learn about identity security and theft.

I learned so much researching and writing this. We are going to update passwords, get a password manager, etc. Take care of all those outstanding risks that we have put off for way too long.

hi shannon. nice article and very useful. i keep my passwords in a binder on paper. if anyone wants them they have to break into my house to try and find them. only mrs. me knows where they are. that sucks with the google play cards.

Excellent point, Freddy!

It sounds like your passwords are secure using a tried and proven method. That works just as well.