What does forced retirement mean? The words invoke anxiety and uncertainty because of the confusion and so many unanswered questions.

It also goes by the names of involuntary job termination, involuntary job separation or downsizing to name a few.

Unfortunately, it is growing and not showing any signs of slowing down in the near future. Here are the top 7 most asked questions with answers to address this alarming trend.

What Does Forced Retired Mean?

One of the most devastating things that can happen is losing your job after the age of 50. Hardly anyone talks about, yet it has been going on for years.

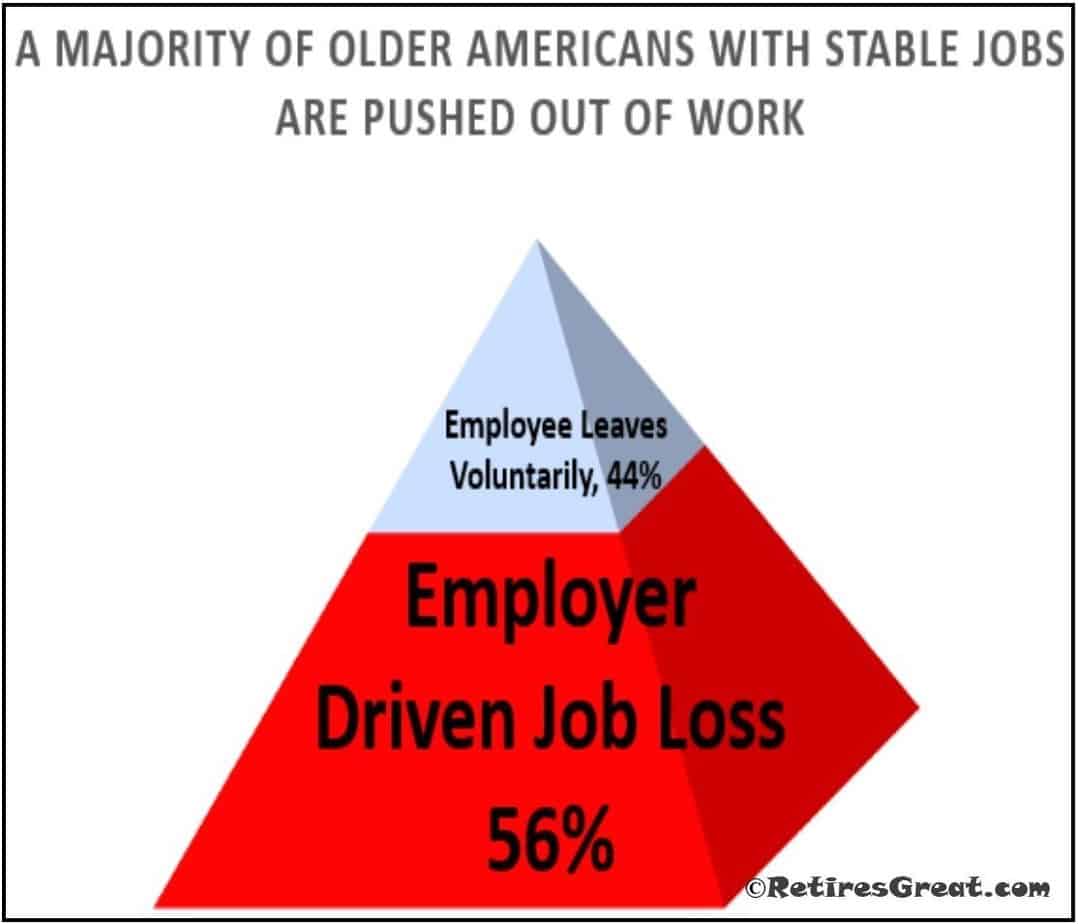

Over half (56%) of all older Americans have or will be shoved out the back door at least once according to ProPublica and the Urban Institute.

Finding new employment can drag out for months and months draining both morale and your savings. On top of that, only 10% will find a comparable position offering the same pay they were receiving.

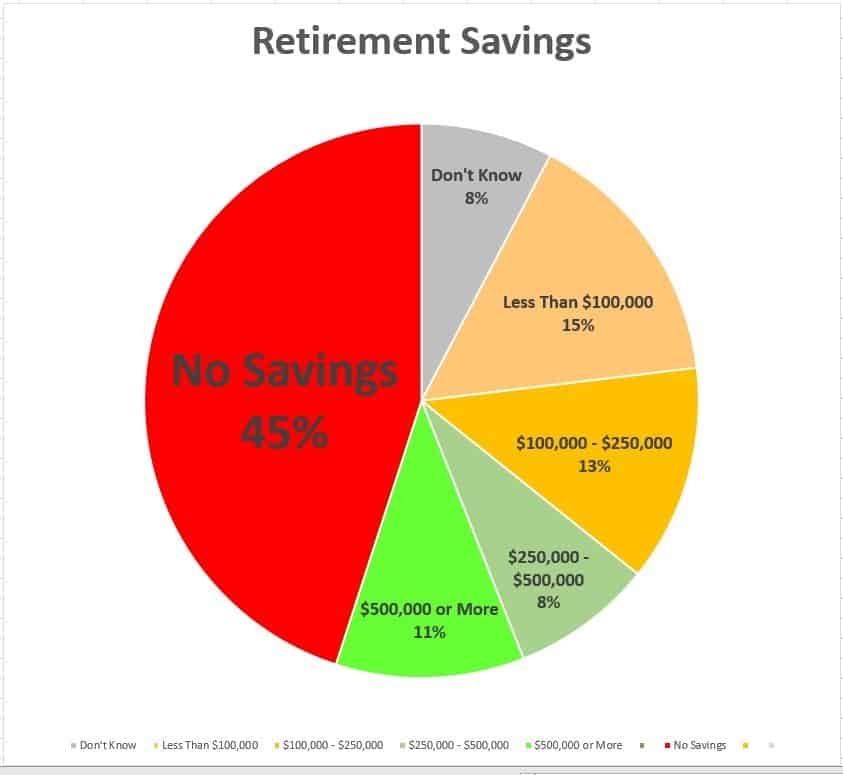

Those final years are crucial for saving and preparing for the future. Almost half of all Americans (45%) have no savings at all according to the Insured Retirement Institute.

They also found that a third of all baby boomers plan to retire at age 70 or not at all. When driven out of work at this critical stage of life, financial recovery becomes problematic.

Why Are Older Workers Being Pushed Out?

On one hand, it makes no sense that organizations would downsize their most experienced and valuable team members.

After all, the company’s success was built on their dedication and hard work. Most of us are at the top of our game in our mid-50's and have much more to contribute.

Yet, management focuses on cost cutting measures instead of recognizing their most valuable assets. Thus, the reward after all those years of service is to be “thrown out with the trash”!

The main problem is too many companies buy into the concept that older workers cost more. There's no question they, typically, command higher salaries. What does forced retirement mean?

Rather than engaging their most loyal employees, they actually demotivate them by the manner in which they treat them.

Opportunities for advancement become non-existent with raises and bonuses reserved for the “young rising stars”.

Feeling under valued and disillusioned, before long these folks are counting down the days until they retire. This reaction further reinforces the reasons to get rid of all older staff.

What a screwed-up system! I’m actually at a loss for words at how messed up the corporate world has become. There appears to be little or no loyalty for all your hard work and experience.

Ultimately, you alone are responsible for your financial independence. Bulletproof your future and avoid forced retirement discusses personal branding and strategies for achieving career success.

Can a Person be Pressured into Retiring?

No one can force you to retire! There are certain specific occupations with a mandatory age restriction such as airline pilots, air traffic controllers, firefighters, law enforcement and military personnel.

The age regulation is based primarily on safety considerations. When individuals in these occupations reach the cut-off age, they may choose to retire or continue working in another field.

In 1986, Congress amended the Age Discrimination in Employment Act (ADEA) abolishing a mandatory age.

Prior to this time, 65 years is what most organizations held as the age to retire. No longer can anyone force you to retire.

Is It Legal?

Age discrimination is illegal. According to CNBC Markets, the House of Representatives recently passed the Protecting Older Workers against Discrimination Act.

“The bill would restore protections eroded by a 2009 Supreme Court ruling in Gross v. FBL Financial Services, Inc., which made it more difficult for workers age 40 and older to sue businesses for age discrimination such as being forced out of a job or denied a work opportunity, according to experts.”

What are Your Rights?

It’s wise to seek legal counsel before signing any waivers or other documents. Generally speaking, the employer must allow you 21 days to review any paperwork.

If you were presented a severance package, the terms and conditions might be negotiable. The rule of thumb varies from one week to fours weeks of pay per every year of service. Also, benefits may be extended.

If you feel you were wrongfully dismissed, a charge can be filed with the U.S. Equal Employment Opportunity Commission (EEOC).

In addition, some states and local jurisdictions also have anti-discrimination laws which would, then, turn your suit into a dual claim.

Your ex-employer will certainly not admit they let you go because of your age! The courts indicate that it must be proven that age was a decisive factor in an organization’s decision.

Of course, lawyers for the company will argue exactly what is meant by someone being pushed out the door.

Their assertion will be that it was necessary to downsize to remain competitive and age wasn’t the deciding factor.

How to Deal with Involuntary Retirement?

Along with what does forced retirement mean is the fall out from it. The initial shock is bad enough, especially if you didn’t see it coming.

It’s easy for it to become personal when it is invoking lots of emotions. Your pride is likely bruised and you feel you have been wronged. Some things to consider include:

If you're one of the lucky few that has achieved financial independence, retiring may be your preferred choice. For the rest of us, paying the bills and finding new employment will be the primary objective.

Even with the strong US economy and low unemployment, it might take awhile to find a decent job. Can you afford to live without a paycheck for six months to a year?

Starting over is never easy, particularly when you have been with the same company for many years. A good employment agency can help you put together a first-rate resume and assist you with your job hunt.

How to Deal with Forced Retirement goes into greater detail on strategies how to recover.

Can You Collect Unemployment Insurance (UI)?

In most cases, you are eligible for unemployment insurance benefits (UI) if you are downsized or otherwise laid off.

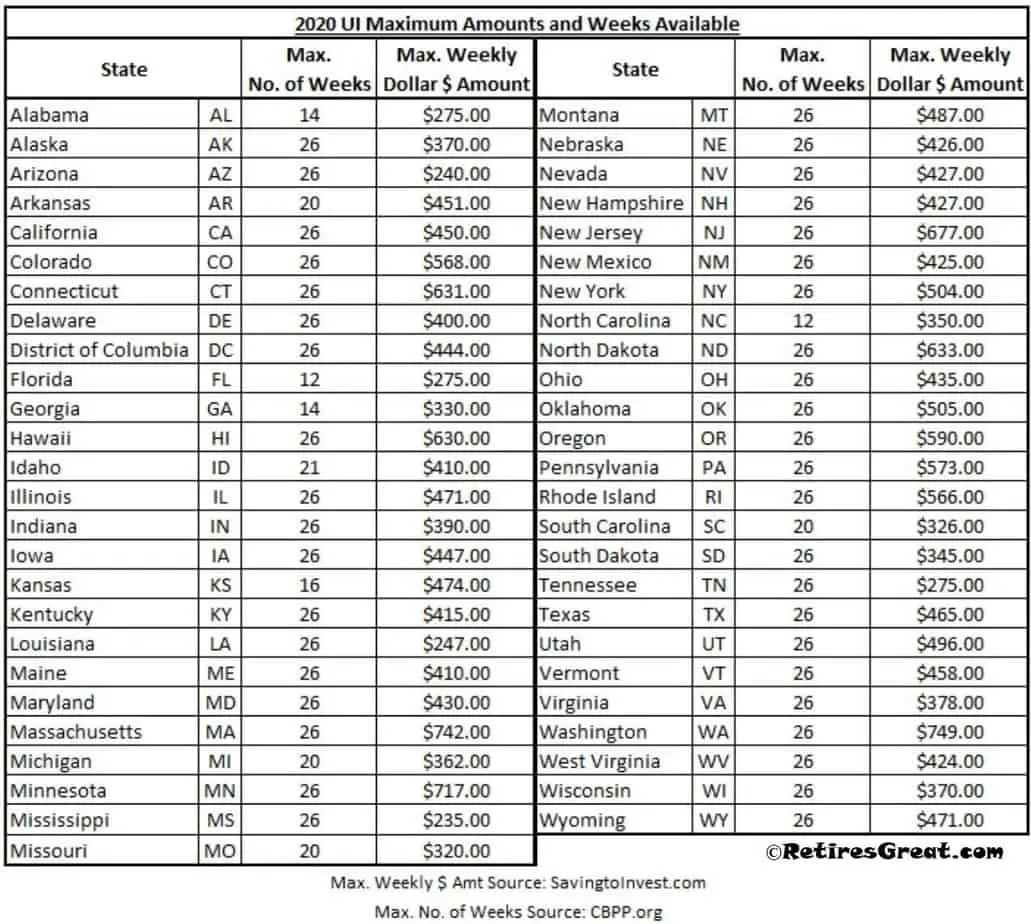

You may lose eligibility if you quit, resign, or were fired with due cause. Each state has their own rules and regulations that determine eligibility, amount paid, and duration.

Although a claim should be submitted immediately after being laid off, any final remuneration can delay UI benefits. This can include severance (plus vacation) pay and/or a buyout package.

The timing and how these are paid to you can also impact the benefits you will receive. For instance, your ex-employer might choose to pay you through a series of payments rather than a lump-sum amount.

In general, most states (there are exceptions) provide benefit periods of up to 26 weeks. The amount you receive depends upon several factors; however, it typically is no more than about half of your previous salary.

If you worked at a part-time or temporary job, your UI checks will be pro-rated. Usually, half the amount you earn is deducted from your check.

If you earn 90% or more of your UI, your benefit becomes zero however your eligibility period may be extended.

How much you will get on unemployment will provide more information. The following chart illustrates the maximum benefit and length of coverage by state:

How will You Financially Survive?

The last thing you want to do is ignore the reality that your income will be dramatically less. The fast track to accumulating massive debt is to continue spending as if you were still working.

Where can you trim expenses? This might be one of those difficult conversations to have with your partner.

Things like going out for dinner, the theater, or a movie are fun, but are they necessary? Most folks put it on their credit card and are shocked when they get their statement.

Even with a strong economy, realistically, how long will it take to get your next job? Lots of 50+ year old job hunters report searches of a year or longer.

With UI benefits running out after 26 weeks, any savings you have will dissipate at an alarming rate. Not having a plan and sticking to a budget becomes a recipe for disaster.

It might be necessary to get a part-time job to help make ends meet. If possible, something that could get your foot in the door toward a full-time position that you would enjoy.

Even with cutting back and part-time income, it may not be enough. Other options to help tide you over until finding new employment can include:

The critical aspect to keep in mind is how to manage your finances.

Closing Thoughts on What Does Forced Retirement Mean

Leaving the work force, by itself, is a huge life changing event. Bottom line, forced retirement is when an older employee loses their job and it was not their decision or choice to leave.

The reality is it’s becoming more and more prevalent with the increasing aging population. Understanding the idea, the difficulties you will face and your available options are very crucial.

Especially when a monkey wrench could be thrown into the mix! This knowledge should make your journey and future a little less bumpy.

Great content! Super high-quality! Keep it up! 🙂

Thanks for that wonderful comment! Glad you are enjoying the posts!